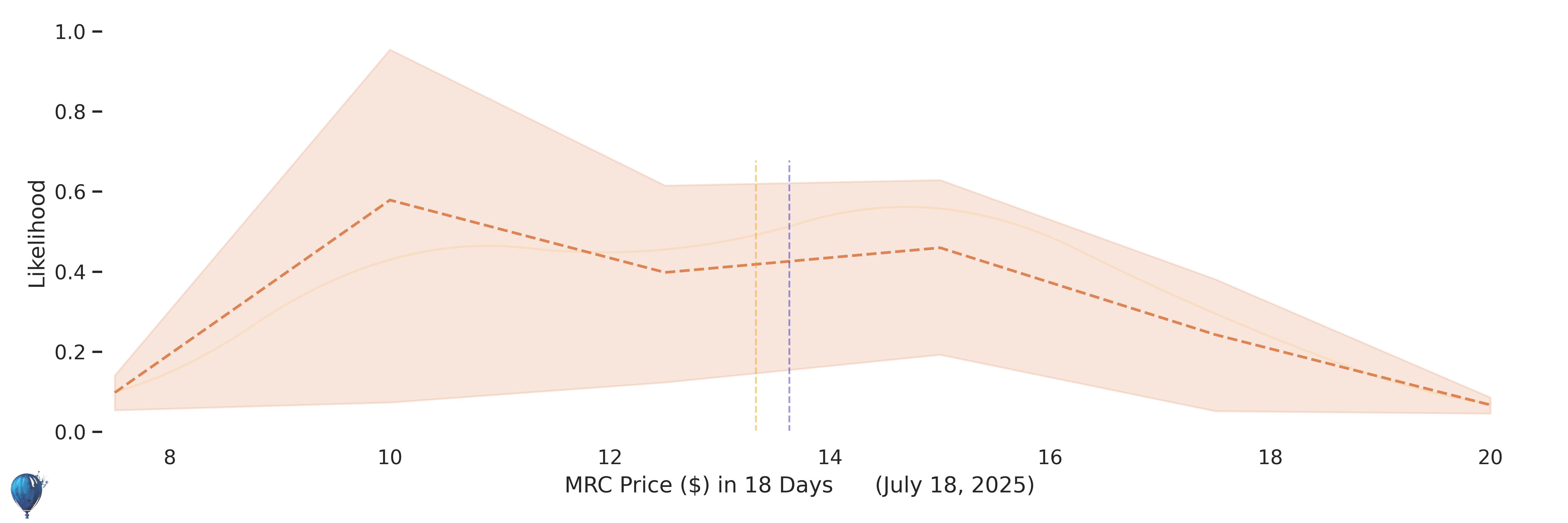

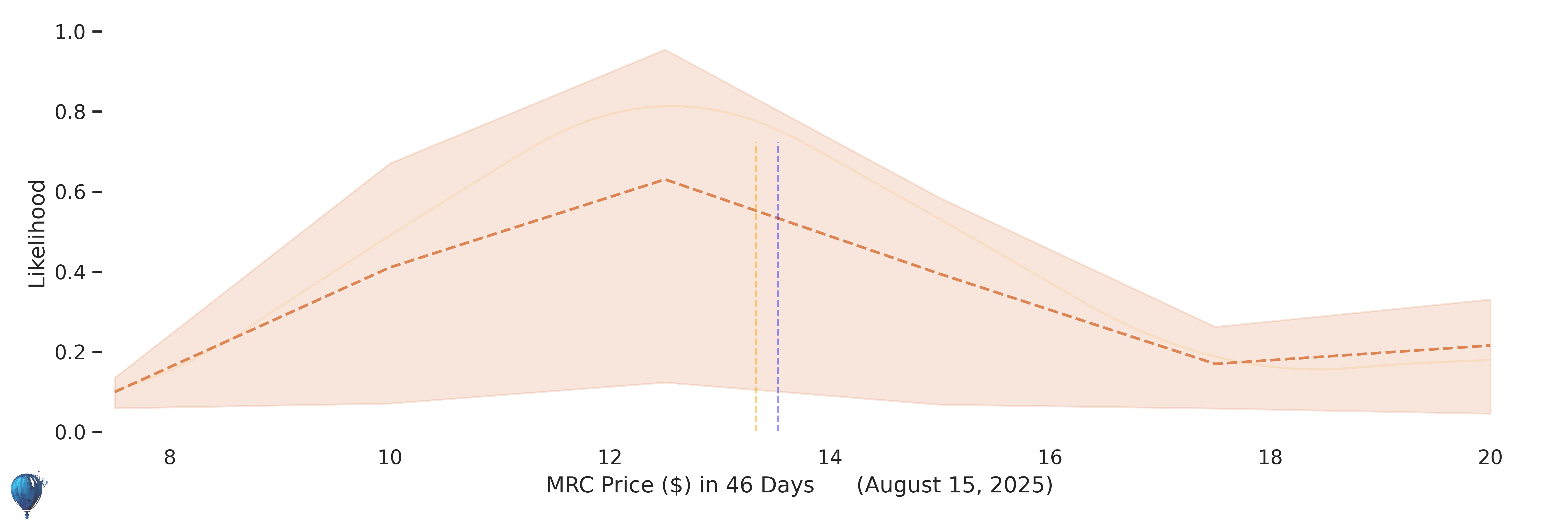

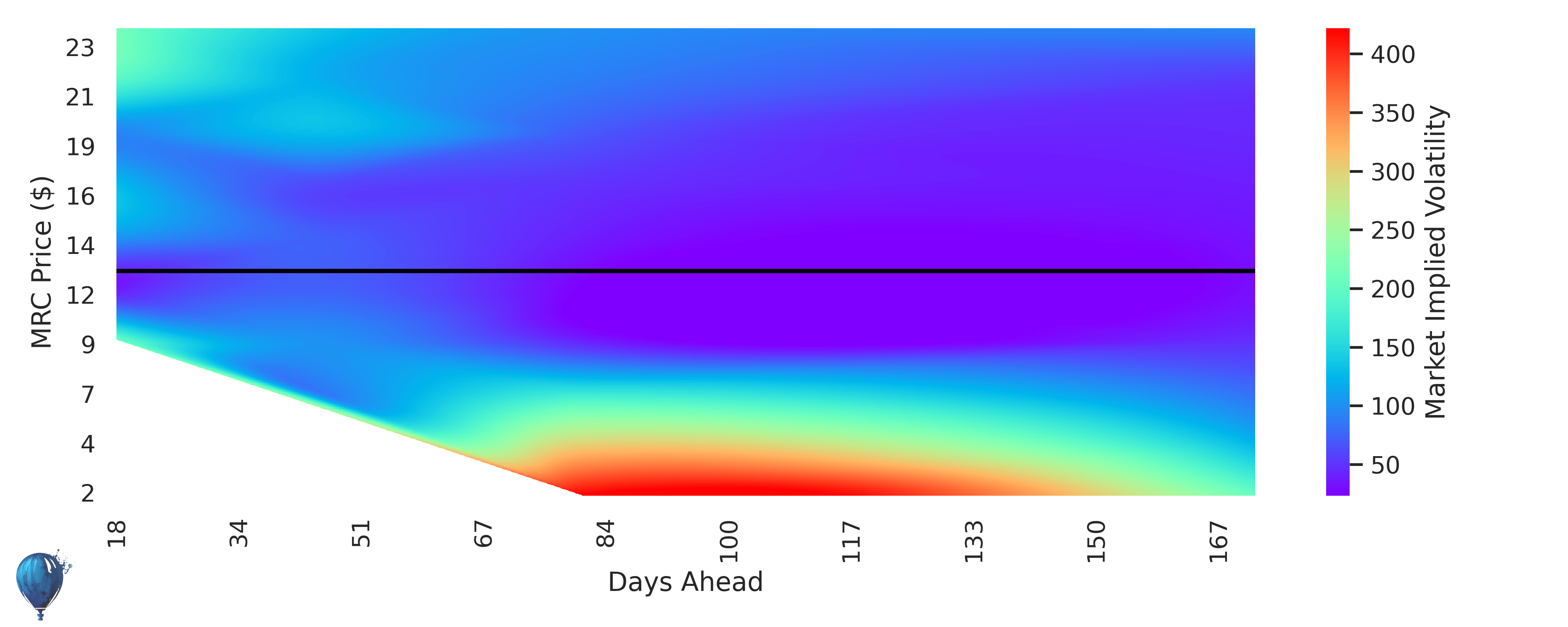

See Market uncertainty and Helium uncertainty over time. Drag slider to change future date.

Market Uncertainty across underlying price and time.

Market Implied Volatility is percent of MRC underlying price.

Higher volatility represents more uncertainty.

Lower volatility represents less uncertainty priced into the market.

The horizontal black line is MRC last closing price.

Share Link: