Max Loss: $23 Max Win: $77

Risk

Odds of Profit (?)

Trade Edge (?)

Historical Performance ( Trades)

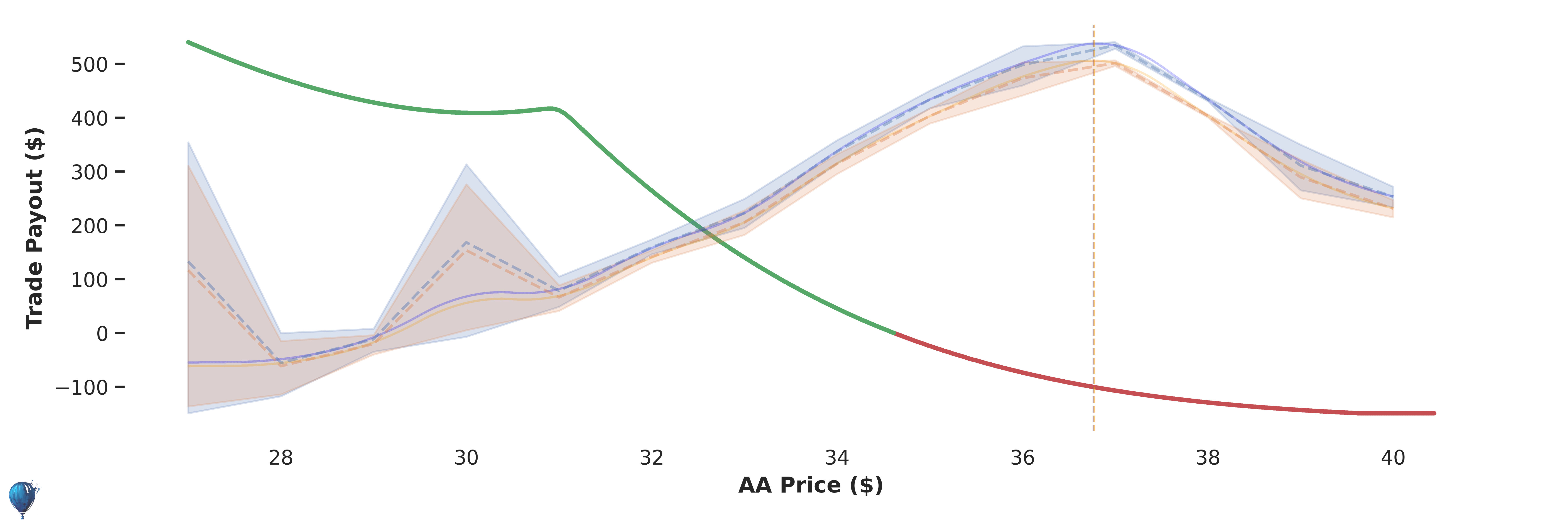

Daily Optimized Bearish Trade Payout in 32 Days