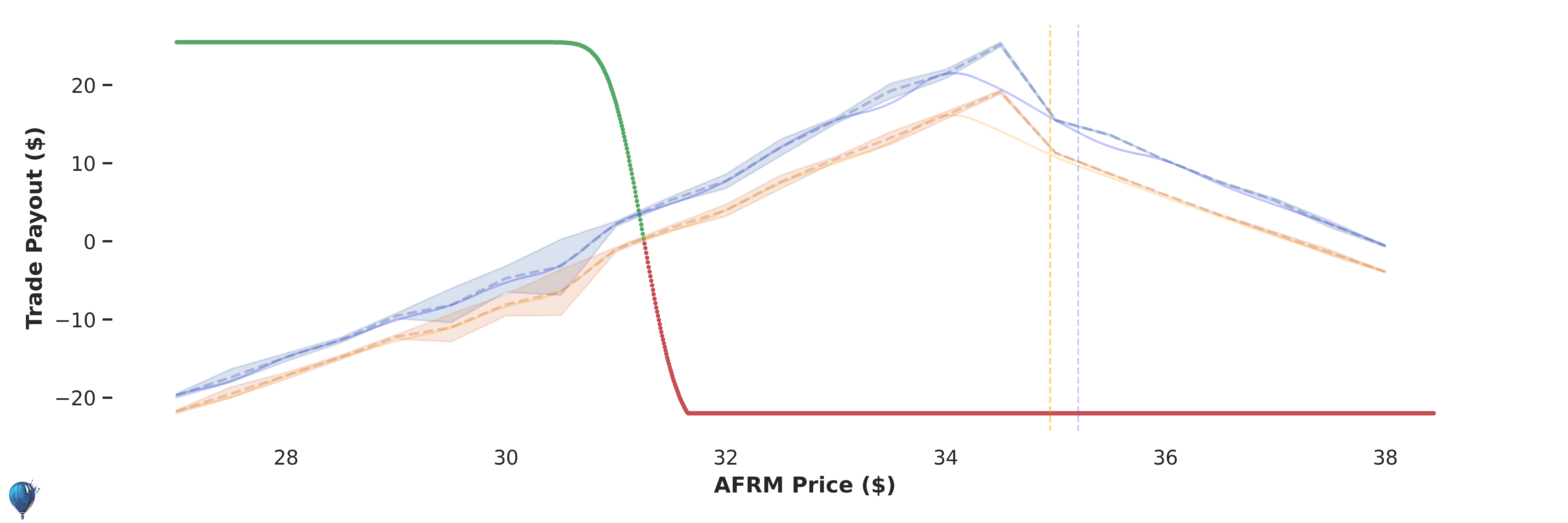

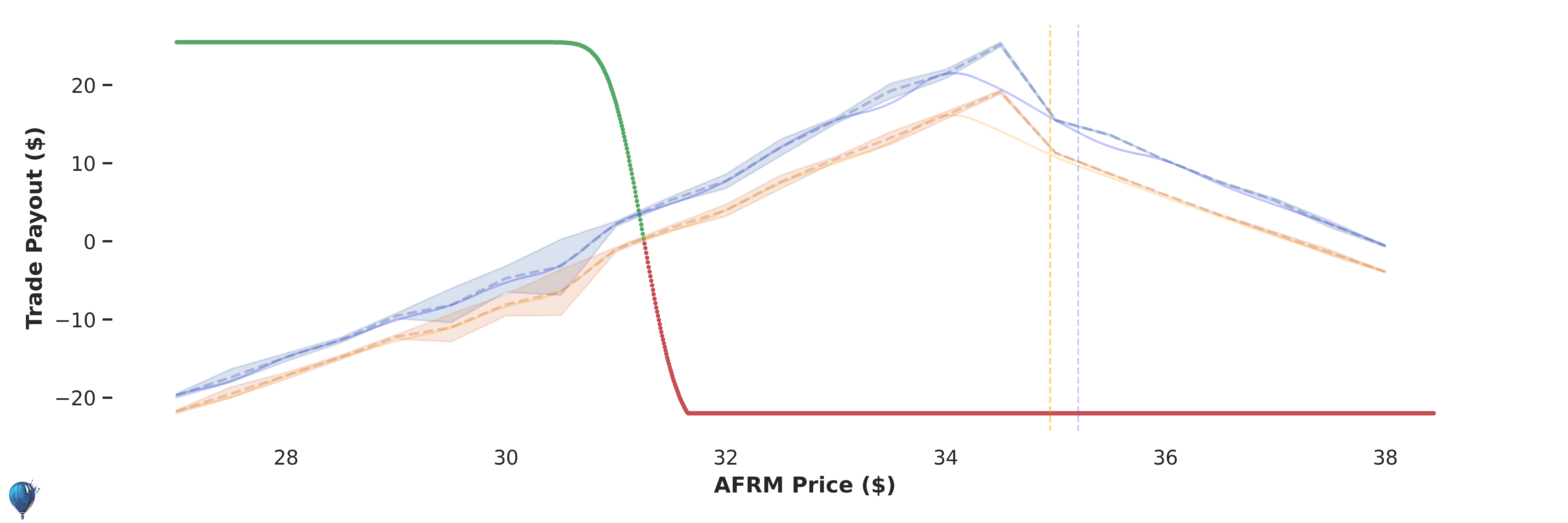

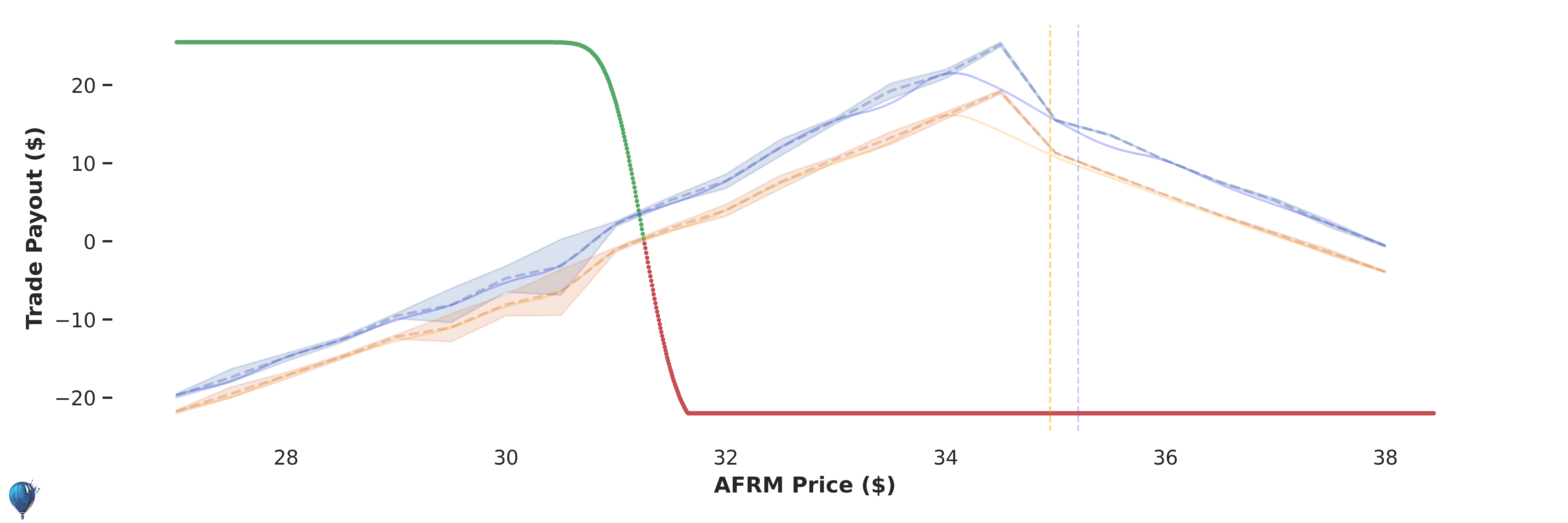

Max Loss: $20 Max Win: $2929

Risk

Historical Performance (44 Trades)

Trade Payout in 1 Days

Green line

Red line Blue line

Orange line

Access Full AFRM Strategy + 1-Click Execution

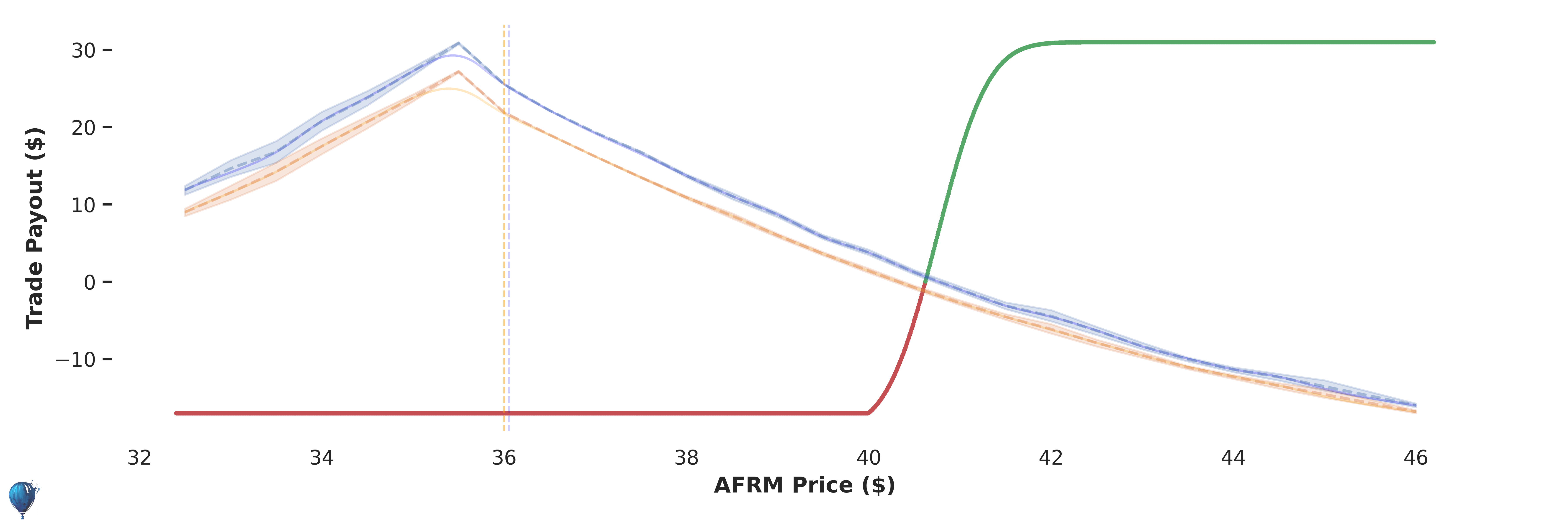

Max Loss: $6 Max Win: $43

Risk

Historical Performance (44 Trades)

Trade Payout in 8 Days

Green line

Red line Blue line

Orange line

Access Full AFRM Strategy + 1-Click Execution