Credit:

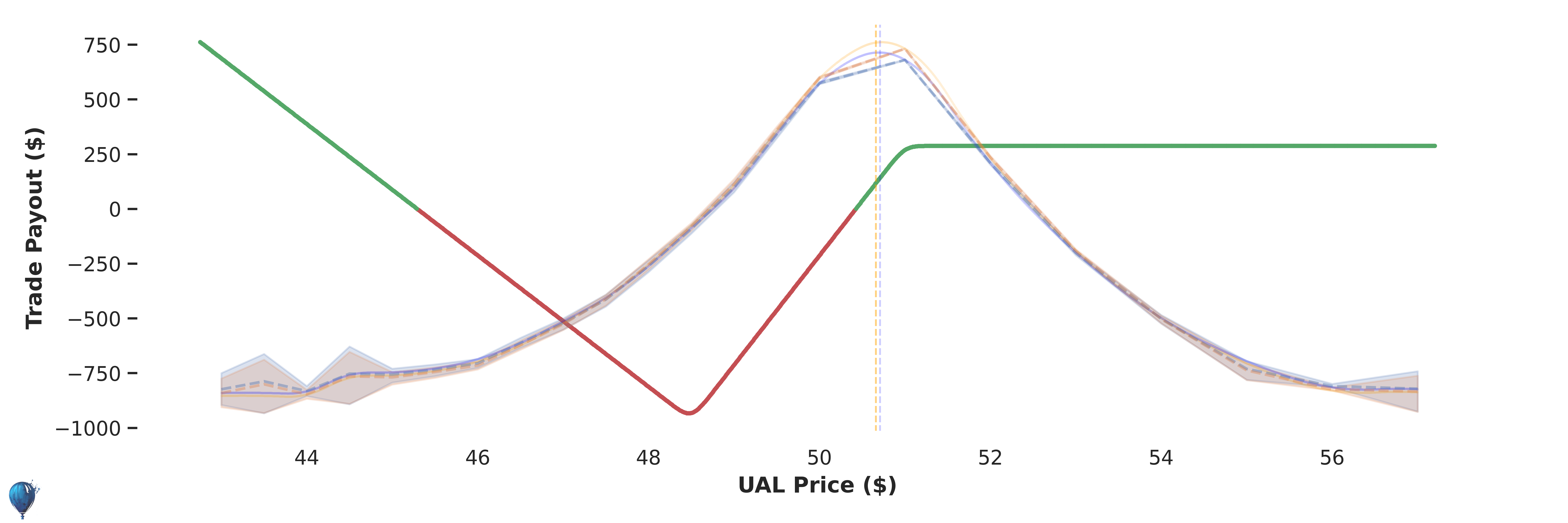

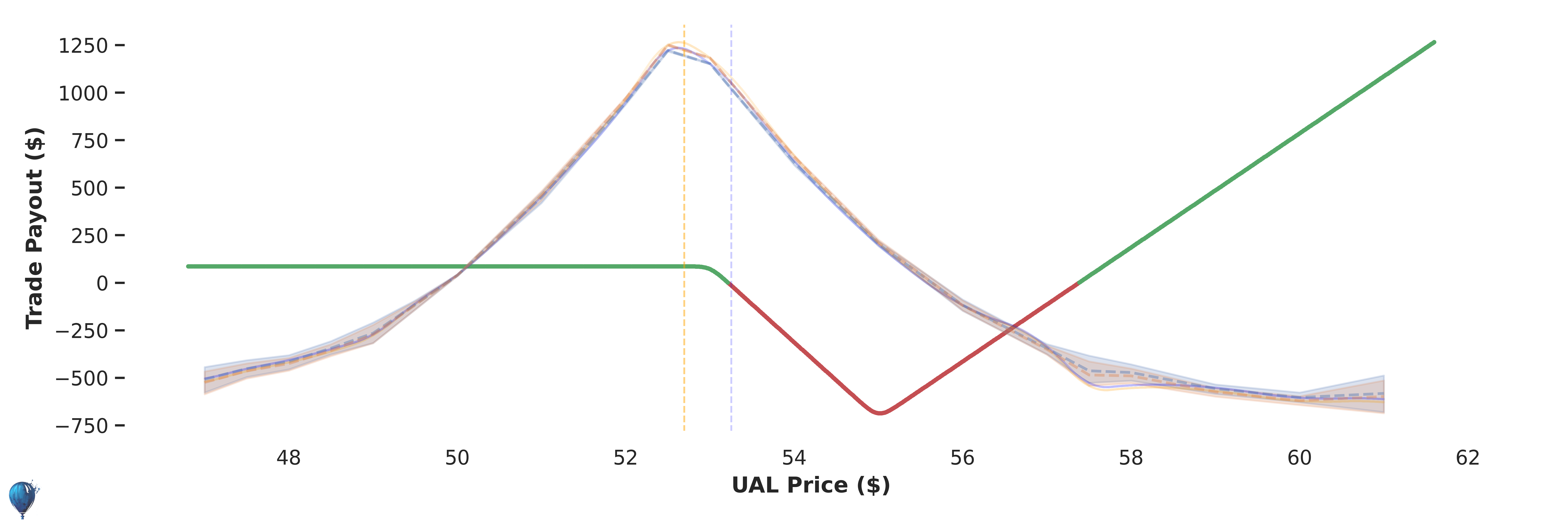

$612

Max Loss:

$1388

Annual Return:

Odds of Profit (?)

Trade Edge (?)

Historical Performance: 151 Trades

Daily Optimized Bullish Trade Payout in 7 Days