Max Loss: $30 Max Win: $7369

Risk

Odds of Profit (?)

Trade Edge (?)

Historical Performance (78 Trades)

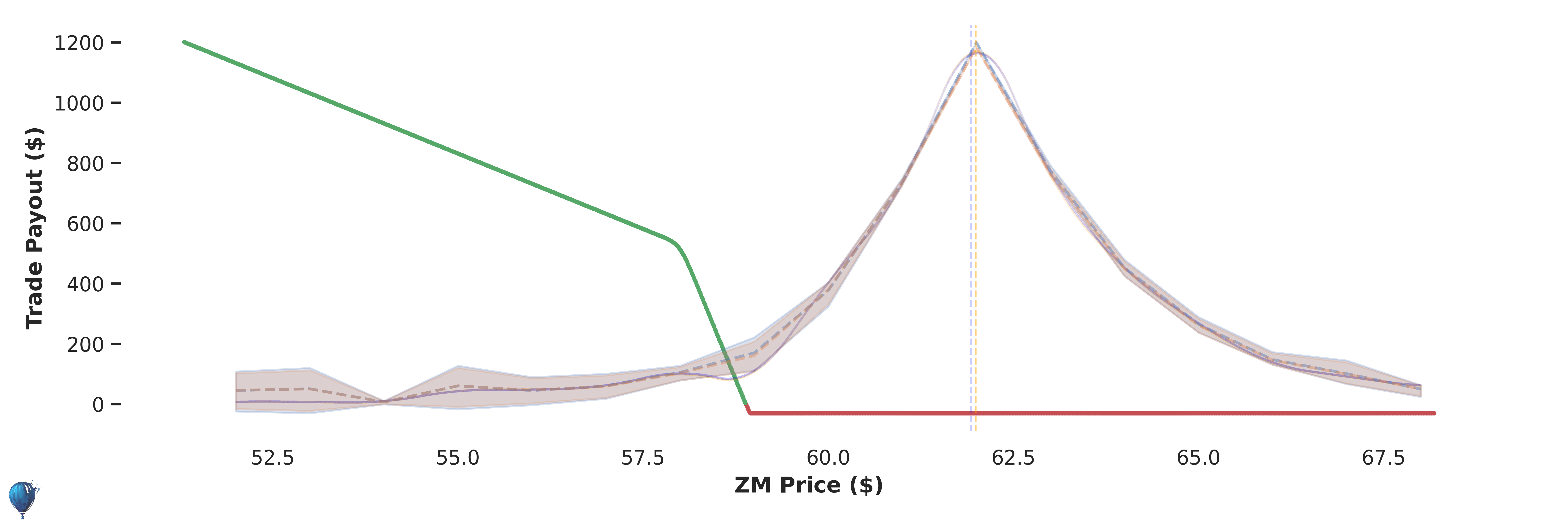

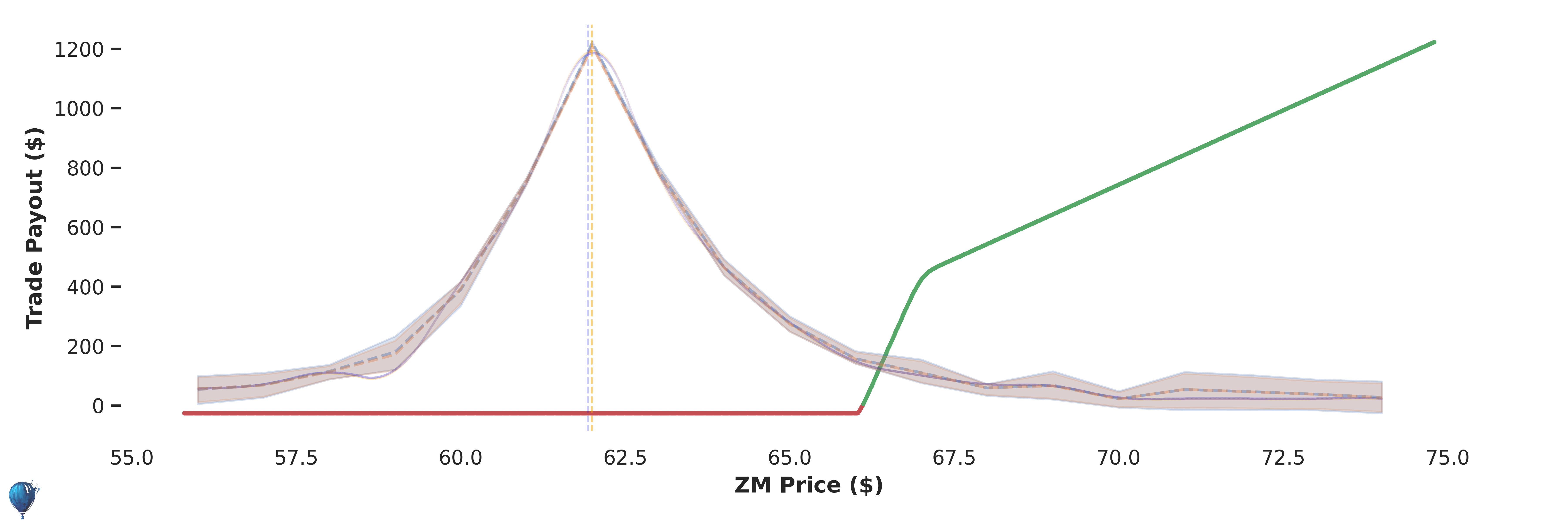

Daily Optimized Bearish Trade Payout in 7 Days