AI Optimized Options Strategies

Supercharge Your Trading With State of The Art Models

Optimized Daily

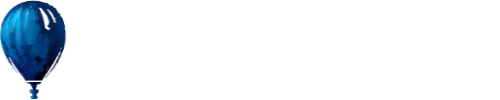

Every day, Helium optimizes and ranks over 200 million options trades to find the best market opportunities for you.

Trade With Edge

Helium combines powerful machine learning with market signals to find trades with positive expected edge.

1-Click Execution

Easily leg into options positions and compete with market makers with our limit order execution algorithm.

Transparent Models

Easily see past performance for ALL trading models.

Supercharge Your Trading with AI-Driven Options Spreads

In the evolving landscape of trading, the use of AI by retail investors has become a game-changer, especially in options trading. Even in relatively efficient markets, by leveraging Helium's AI, traders can enhance their decision-making processes, optimize strategies, and ultimately improve profitability and ability to compound. Helium Trades stands at the forefront of this innovation, offering cutting-edge AI-driven options strategies that are designed to supercharge your trading and market research.

Options Trader? Swing Trader? Check out our AI-driven Strategies

Whether you're an options trader or a swing trader, Helium Trades provides AI-driven strategies that cater to your specific needs through our AI forecasts, balanced news, and high-level market graphs. Our platform uses sophisticated algorithms to analyze market data, identify trends, and generate empirical, transparent, and actionable insights. This empowers traders to make informed decisions, reduce risk, and maximize returns.

Retail Option Trading Made Easy

Leverage Models Previously Only Accessible by Large Institutions.

High-level Dashboard

Easily see all your trades in one place. Have AI helpy ou improve your portfolio.

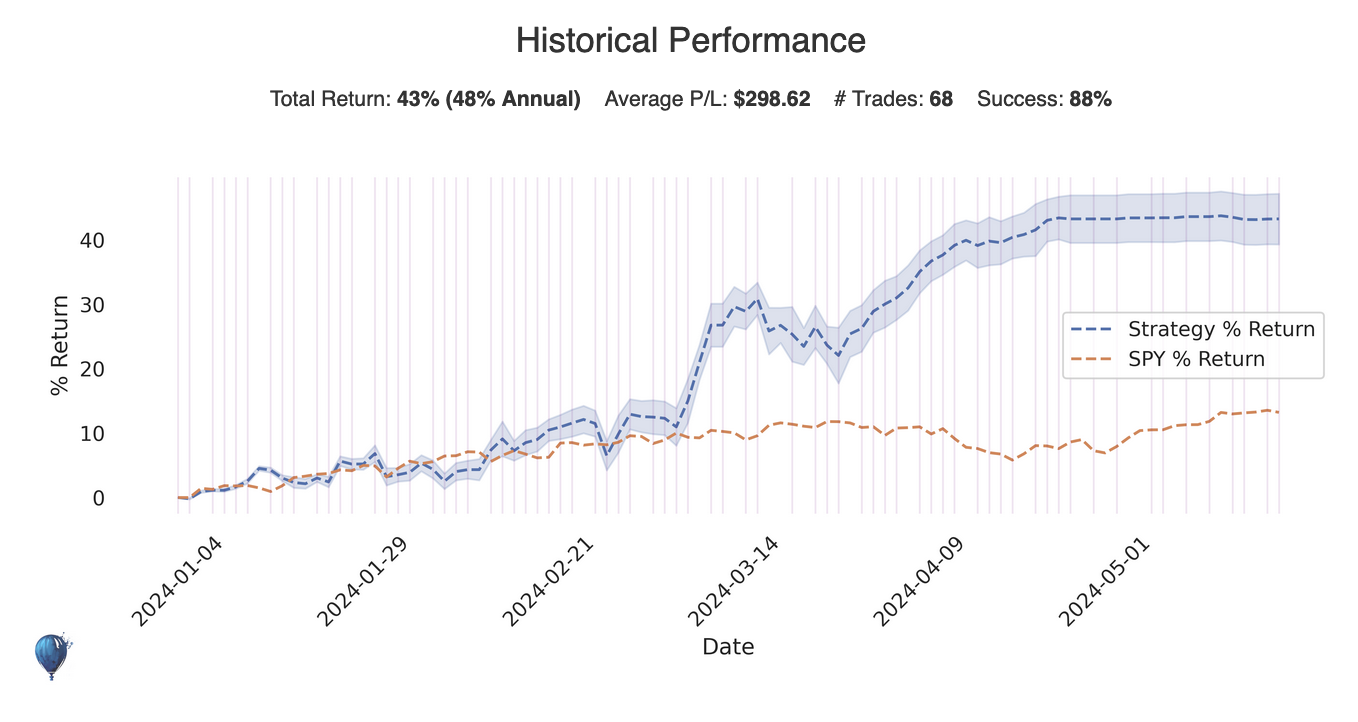

Historical Performance

See past performance for ALL trading strategies.

AI News Analysis

Synthesize key information from multiple perspectives in seconds.

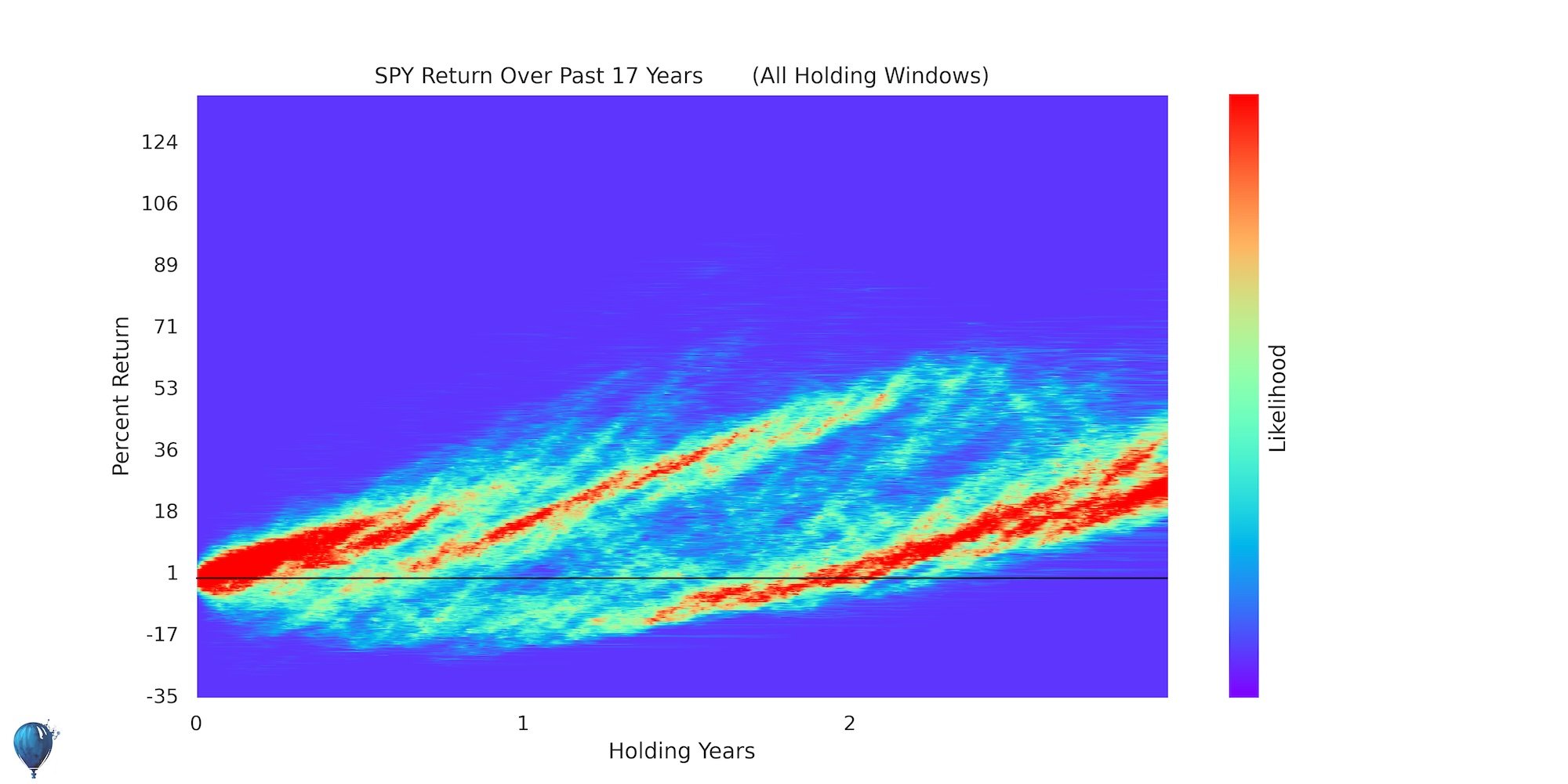

Daily Trade Chart Zones

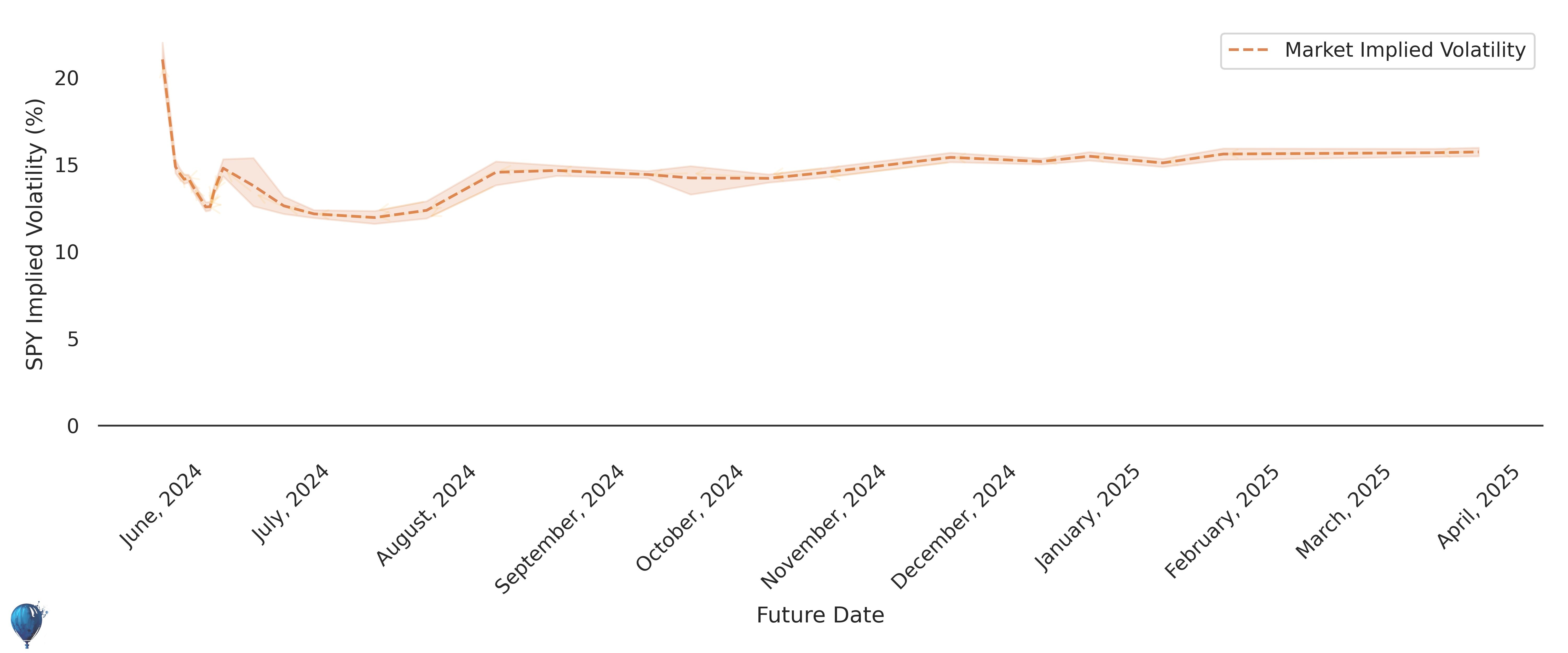

One of the standout features of Helium Trades is the daily-updated forecast cones. These zones are dynamically updated based on current market conditions and AI predictions, providing traders with a high level view of the most likely price outcomes. By visualizing these zones in an 80 percent confidence interval, traders can better understand market movements and use probabilities to execute trades with confidence.

We Make Research Effortless

Research is a critical component of successful trading, but it can be time-consuming and complex. Helium Trades simplifies this process with its AI-driven research tools that allow it to synthesize information from news, the volatility surface, and AI price models. Our platform automatically scans and analyzes vast amounts of price and alternative data from multiple sources, offering a comprehensive view of the market. This enables traders to make data-driven decisions without spending hours on biased research.

Select Trade Type

Helium Trades allows users to select between long volatility and short volatility with tail convexity. This allows traders to balance the premium of being short options with the benefits of convexity and long uncertainty.

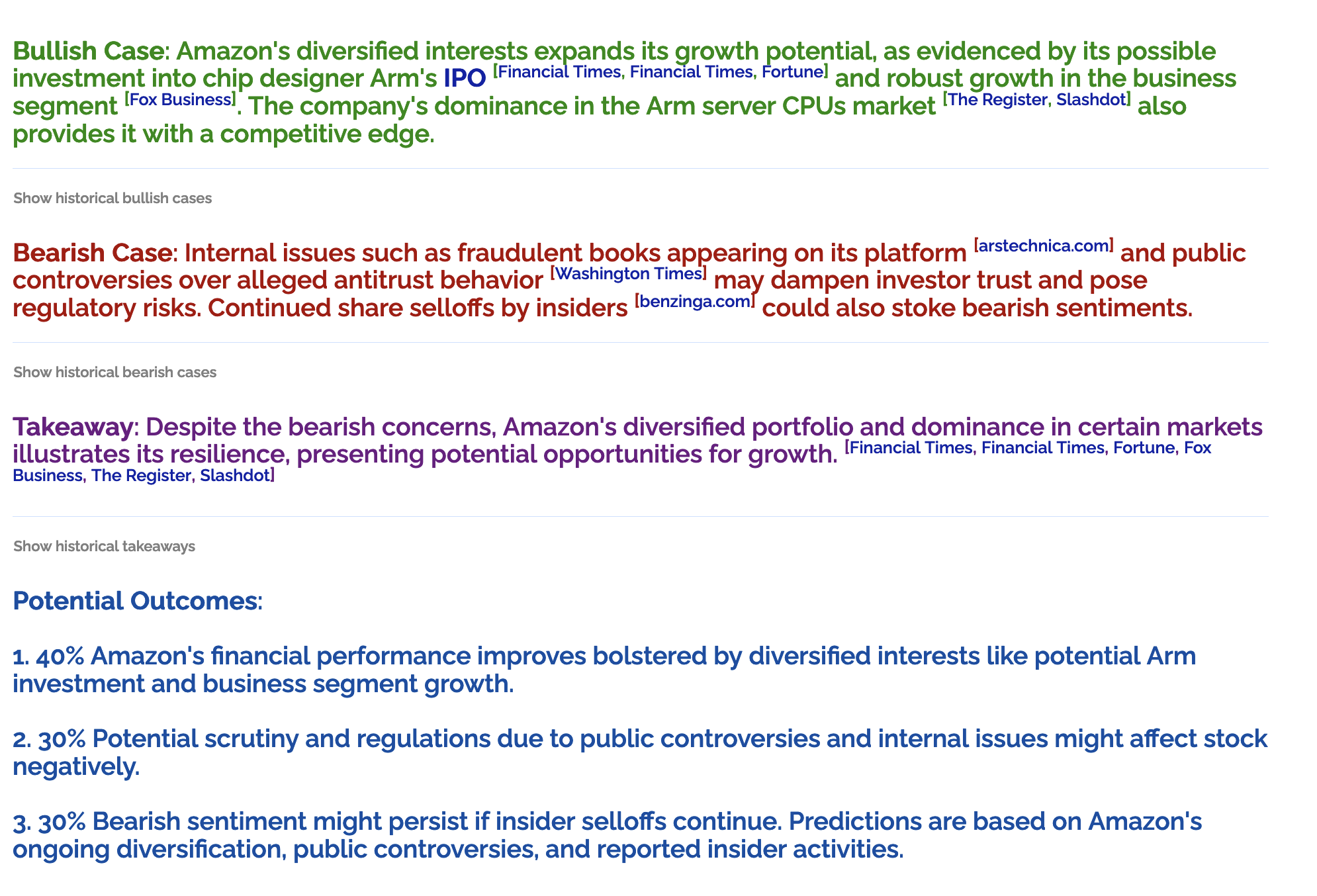

View Bullish and Bearish Cases

The Helium platform provides detailed insights into bullish narratives, bearish narratives, probabilistic potential outcomes for relevant events, and bespoke trading strategies based on the volatility surface and pricing opportunities in the market.

Set Ticker Alerts

Stay ahead of the market with customizable ticker alerts written by AI and sent directly to your inbox. Helium Trades notifies you of updates that could influence your trades, allowing you to act swiftly and strategically based on statistical forecasts and news analysis from thousands of sources.

Recent Helium Trades Alerts

Stay informed with our recent trade alerts in the Weekly Wave email every Wednesday. Helium Trades continuously monitors the market and provides alerts on potential trading opportunities as they arise. These alerts are based on our AI's thorough and nuanced analysis, ensuring that you never miss out on a lucrative trade. Every model on helium is updated daily based on closing options prices.

Save Countless Hours with our AI-driven Strategies

Time is a precious commodity in trading (and in life). Helium Trades helps you save countless hours by automating the analysis and decision-making processes. Our AI-driven strategies are designed to identify only the best trading opportunities, so you can focus on other things while Helium research + execution runs in the background.

Helium Trades Helps Every Type of Investor

Helium Trades is versatile and caters to every type of investor, whether technical, value, opportunistic, high-frequency, or long-term.

Technical

For technical traders, Helium Trades offers simple charting tools with confidence intervals and measures of historical performance from our AI-driven pattern recognition. These features enable traders to identify trends, mean-reversion, and autocorrelation with precision.

Opportunistic

Opportunistic traders can leverage our daily AI to capitalize on short-term market movements and options price dislocations. Helium Trades identifies high-probability setups with a high reward:risk, allowing traders to seize opportunities as they arise.

Long-term

Long-term investors benefit from our comprehensive research synthesis, featuring fundamental + news analysis for longer-term price forecasts. Helium Trades provides insights into market trends, helping long-term investors make informed and statistical decisions about their portfolios.

Can AI be Used for Options Trading?

It already is every day. AI is particularly well-suited for options trading due to its ability to process vast amounts of options price data, identify patterns, epistemically regularize, and make predictions in a repeatable way. Helium Trades harnesses the power of AI to optimize options trading strategies, providing relail traders with a significant edge in their portfolios.

How Does Helium’s Strategy Work?

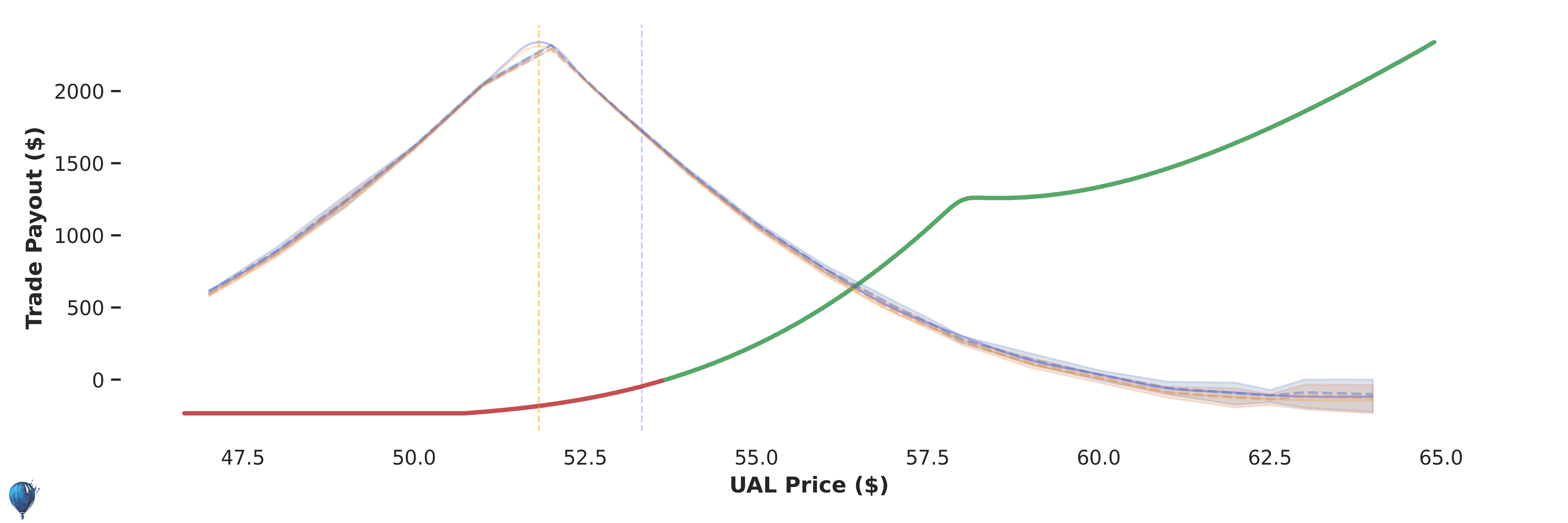

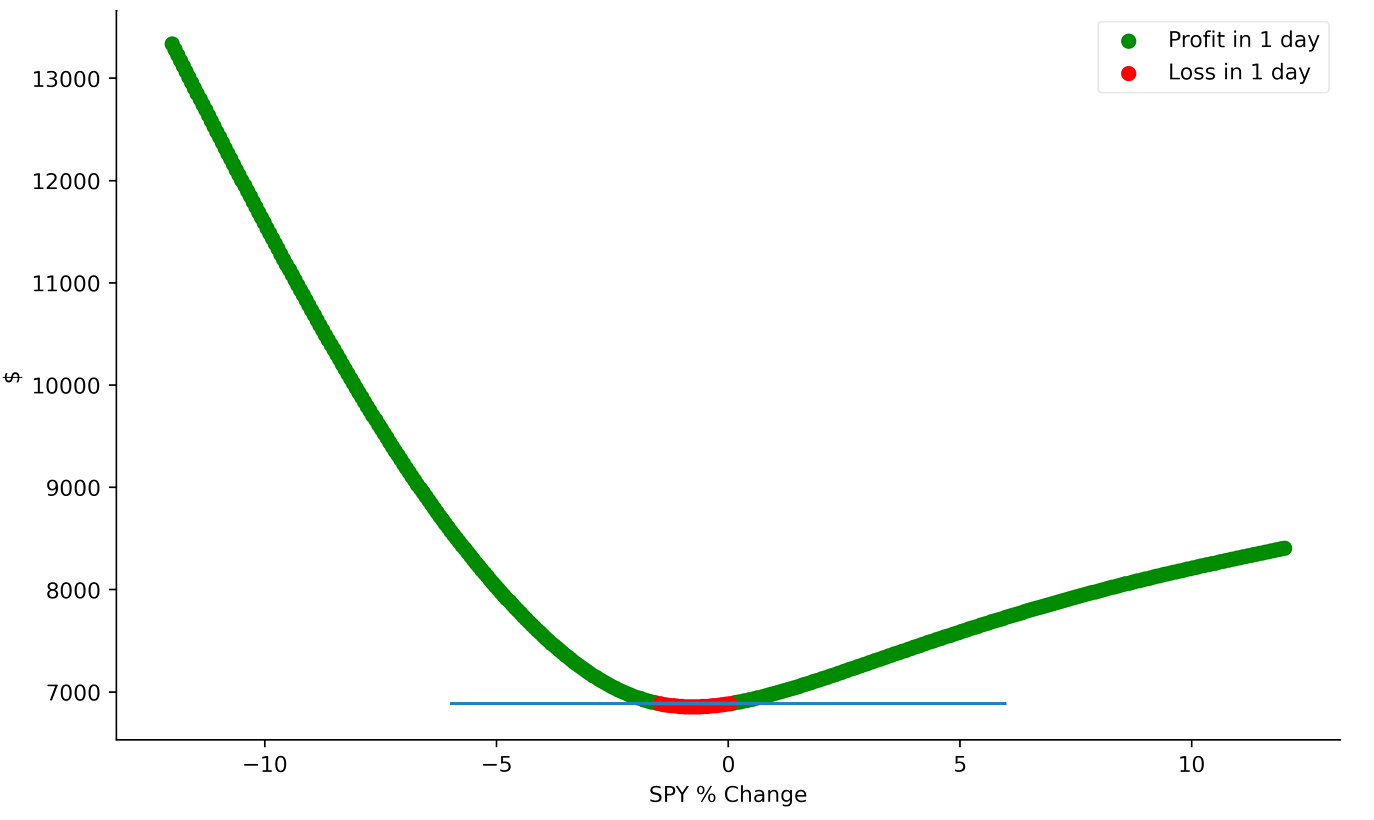

Helium’s strategy for short volatility involves selling an at-the-money (ATM) option and buying multiple out-of-the-money (OOTM) options to hedge. This approach is designed to capitalize on the time decay of the sold option while protecting against significant market moves with the hedged positions.

“Helium Trades combines the best of both worlds by selling rich options while over-hedging with low delta options, thus optimizing for a favorable risk-reward balance.”

The rationale behind this strategy is rooted in supply and demand dynamics. By selling ATM options, traders can benefit from the premium decay, which is typically accelerated due to the higher implied volatility (and ATM options have the highest theta usually). Meanwhile, the OOTM options serve as a protective measure, providing a cushion against unexpected market swings.

Example: Suppose you sell a 30-day ATM call option on a stock trading at $100, receiving a premium of $5. Simultaneously, you purchase two 30-day OOTM call options with strike prices of $110, each costing $1. This setup provides you with a net credit of $3 while limiting your downside risk if the stock makes a significant upward move. If the price remains below your short strike of $100 you keep your credit.

Moreover, Helium’s strategy employs a multifaceted approach that includes:

- High Convexity and Reward:Risk: Optimizing for potential acceleration in the value of the option relative to the underlying asset’s price.

- Market Expected Value: Using conservative assumptions to maximize the expected terminal value of each position based on market prices and Black-Scholes probabilities.

- Helium Expected Value: Employing regularized machine learning models to forecast and maximize the expected terminal value of each trade.

- Minimizing Time Decay: Reducing the carrying cost of long options by minimizing theta decay.

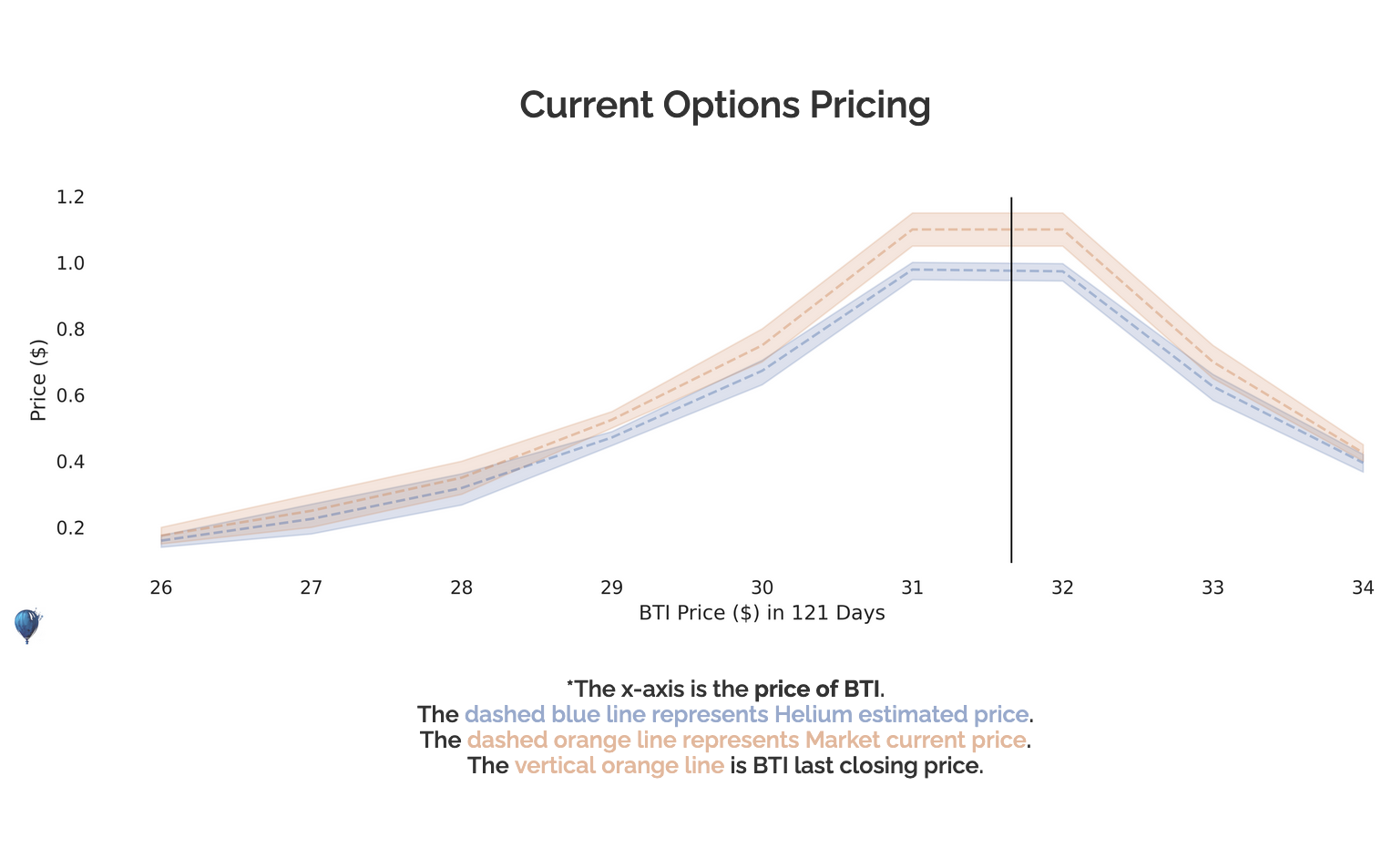

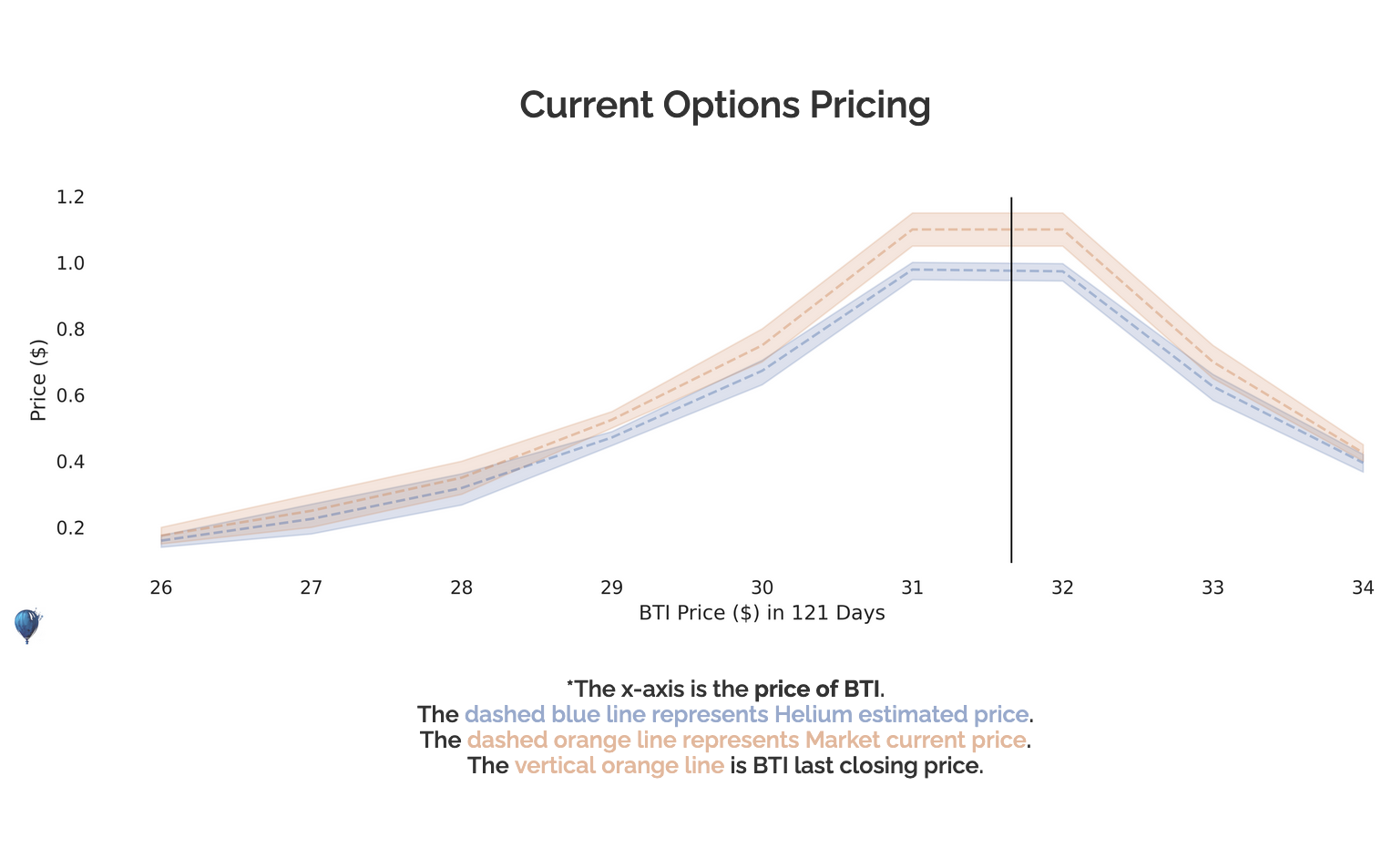

- Helium vs. Market Uncertainty: Identifying underlyings with potentially under-priced risk by comparing market and Helium uncertainty levels.

- Cost Efficiency: Optimizing for cheaper options/spreads to minimize potential maximum loss.

- Long Trade Duration: Focusing on options with longer expiration to allow more time for significant underlying moves.

- Maximum Option Lifetime Value: Predicting and maximizing the highest price over the option's lifetime for the long leg while minimizing it for the short leg.

- AI Price Forecasts: Weighting call options higher on bullish stocks and put options higher on bearish stocks based on machine learning forecasts.

- Low Implied Volatility Rank (IVR): Seeking assets with lower IV to exploit potential IV expansion.

- High Liquidity: Prioritizing trades with tighter bid-ask spreads to enhance execution efficiency.

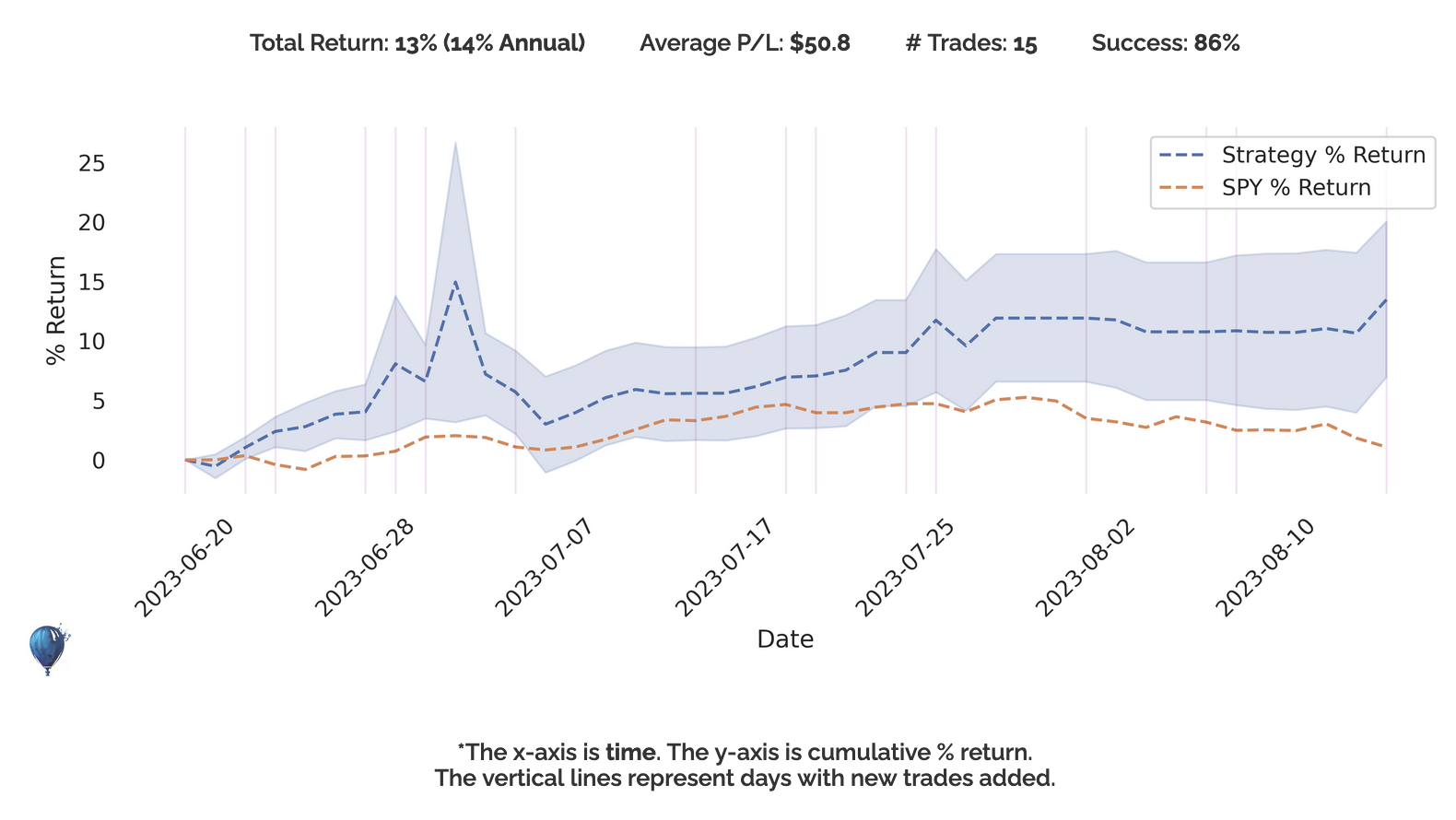

- Historical Performance: Relying on models with a historically high risk-adjusted return.

- Selling High IV & Buying Low IV: Optimizing for selling options with higher implied volatility and buying options with lower implied volatility.

Is AI Better at Trading Than Humans?

AI has several advantages over human traders, including the ability to analyze large datasets quickly and without psychological biases, identify statistical and testable patterns, and execute trades rationally without emotional bias. However, the best results are often achieved when AI is used to augment human decision-making. Helium Trades provides the tools and insights that allow traders to leverage AI while maintaining control over their portfolios.

What is the Best AI Trading Platform?

The best AI trading platform depends on your specific needs and trading style. However, Helium Trades is highly regarded for its comprehensive suite of tools + daily updated strategies, user-friendly interface, and powerful AI-driven analysis. Our platform is designed to cater to both novice and experienced traders, providing the insights and automation needed to succeed whatever the current market is pricing.

How to Build AI for Trading?

Building AI for trading involves multiple key steps:

- Data Collection: Gather historical and daily market + options data, including prices, volumes, news data with bias analysis, and fundamental indicators.

- Data Preprocessing: Clean, normalize, and regularize the data to ensure it is suitable for analysis and modeling.

- Feature Engineering: Create relevant features that can be used to predict market movements, such as technical indicators, historical prices, news data, trends, and sentiment scores.

- Model Selection: Choose appropriate machine learning models, such as decision stumps with boosting.

- Training and Validation: Train the models on historical data and validate their performance using a separate dataset to reduce the likelihood of overfitting (just cheating to memorize the data).

- Backtesting: Test the models on historical data to evaluate their performance and robustness across multiple statistical tests.

- Deployment: Implement the models in a live trading environment, integrating them with trading platforms and execution algorithms.

- Monitoring and Maintenance: Continuously monitor the model's performance and make adjustments as needed to ensure optimal results while continuously rebalancing your portfolio.

Conclusion

Helium Trades offers a powerful suite of AI-driven options strategies designed to enhance your trading performance. By leveraging advanced algorithms and holistic data analysis, Helium Trades empowers traders to make informed decisions, optimize their strategies, and ultimately achieve better results for their understanding and their portfolios. Whether you're a technical trader, an opportunistic trader, or a long-term investor, or not sure, Helium Trades has the tools and insights to help you succeed in the dynamic world of options trading and markets.

Author: Conner Lambden

Conner is the founder of Helium Trades and a former computational scientist studying the immune system. Connect with Helium on Twitter.