3 Strategies for Trading Volatility With Options

Volatility trading is not just about taking advantage of market swings (or lack thereof); it's about understanding the intricate mechanics that drive these fluctuations and systematically taking advantage of them. Helium Trades has always emphasized a probabilistic approach to volatility, focusing on strategies that align with empirical evidence, live P/L, and real-world applications. This article delves into three advanced volatility trading strategies through a lens of a Helium volatility trader.

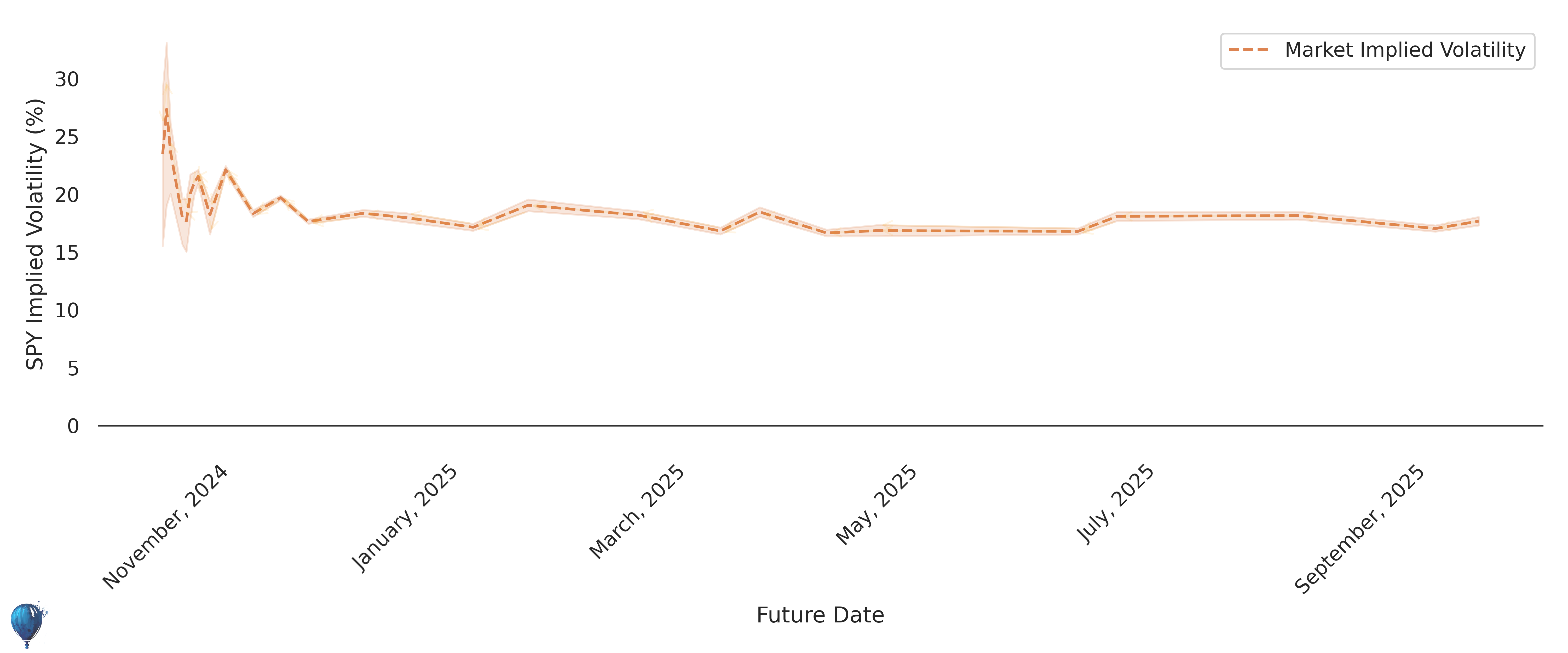

SPY Term Structure: The term structure of volatility is a critical component of options pricing, reflecting the market's expectations of future volatility over time from ATM (at-the-money) options. The term structure can provide valuable insights into market sentiment, risk appetite, and potential trading opportunities.

5 Factors That Determine the Price of an Option

Before diving into specific strategies, it's crucial to grasp the different elements that influence option pricing. The Black-Scholes model, the swiss army knife of financial theory, highlights five primary determinants:

- Underlying Asset Price: The foundation of any option, the current market price of the underlying asset. This is reflected in delta risk.

- Strike Price: The pre-agreed price at which the option can be exercised, pivotal in defining intrinsic value.

- Time to Expiration: The duration until the option's maturity, with longer durations generally increasing the option's premium due to greater uncertainty.

- Volatility: The expected volatility of the underlying asset's price, a critical factor that directly impacts the option's extrinsic value. Additionally, higher moments of the distribution such as skew + kurtosis affect how implied volatility changes across the volatility surface.

- Risk-Free Interest Rate: The prevailing risk-free rate, influencing the cost of carry and, consequently, the option's price. Higher interest rates increase the value of call options. However, compared to delta/vega/gamma risk, rho is relatively less important from a P/L perspective.

An in-depth understanding of these factors (and their relationships) is essential for any trader looking to exploit volatility through options.

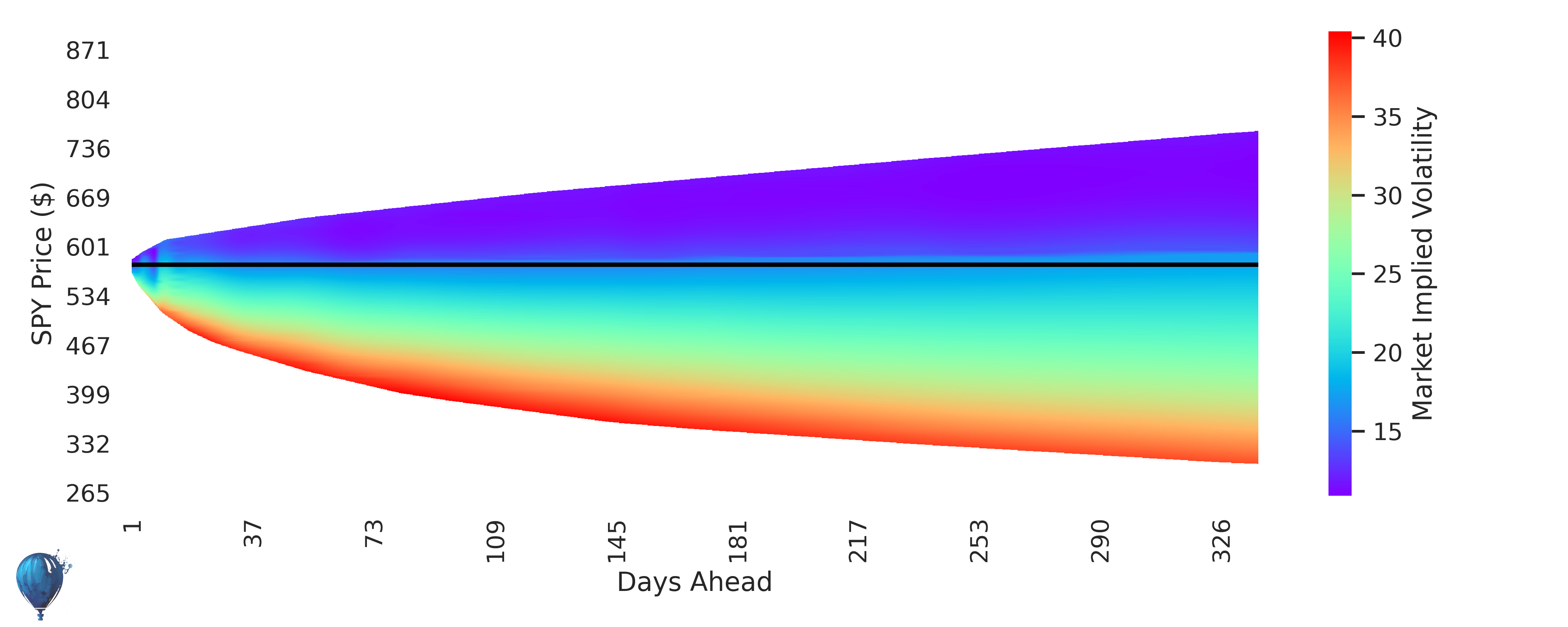

SPY Volatility Surface: The volatility surface provides a comprehensive view of implied volatility across different strike prices and expiration dates, offering insights into market expectations and potential trading opportunities in one glance.

Go Long Put Spreads

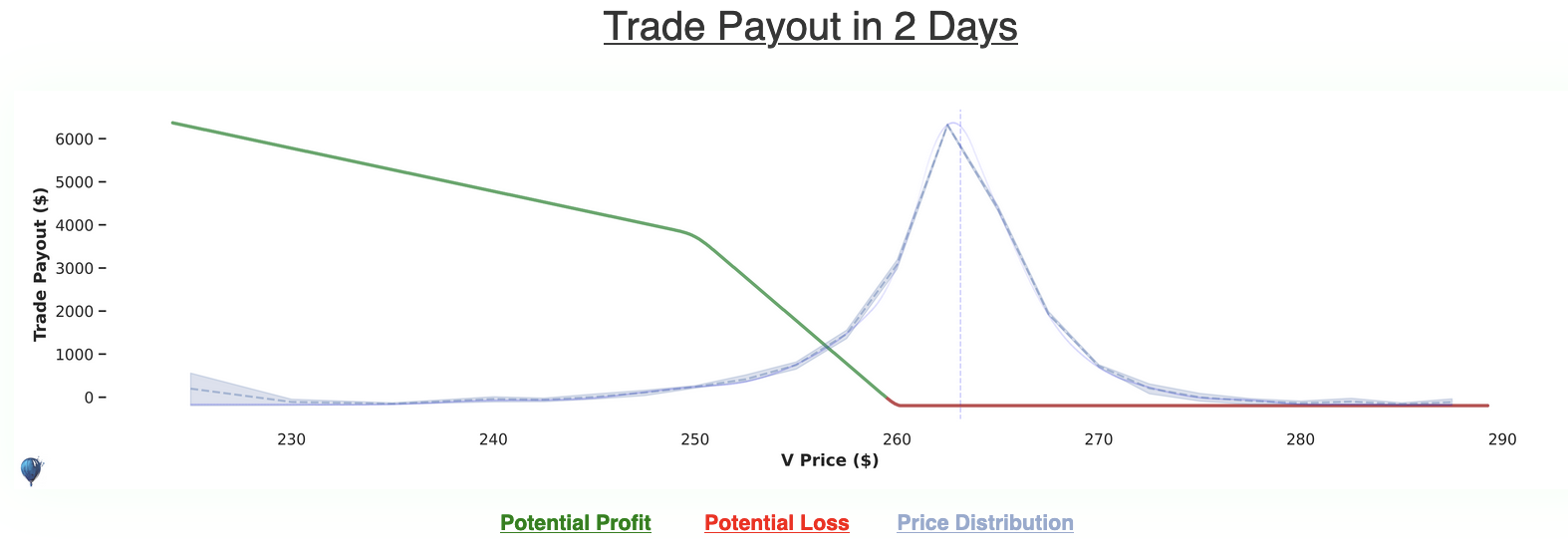

Long put spread: A bearish strategy that profits from declines in the underlying asset's price and increases in implied volatility. By purchasing put options and selling lower delta puts, traders can reduce the cost of the position while maintaining exposure to potential gains. This strategy is particularly effective during market downturns or in anticipation of negative news, offering a straightforward yet powerful way to capitalize on bearish market conditions.

Long put spreads (Helium Long Volatility) are a straightforward yet effective strategy for being bearish and long volatility. By purchasing put spreads (buying puts and selling lower delta puts), traders can profit from declines in the underlying asset's price as well as increases in implied volatility. This strategy is particularly powerful during market downturns or in anticipation of negative news. Even if they don't expire in the money, tail options can increase dramatically in price during risk-off events.

Example: Imagine a trader buys a put spread for a stock currently trading at $100 by purchasing a $90 put and selling 2 $85 puts. If the stock plummets to $80, the put spread's value surges, allowing the trader to capitalize on the decline. The risk is limited to the premium paid for the spread, while the potential gain can be substantial if the stock's price falls significantly. Most of Helium's put spreads are long convexity (buying more puts than we are selling) to take advantage of large downmoves or sudden demand for tail options.

Short Call Spreads

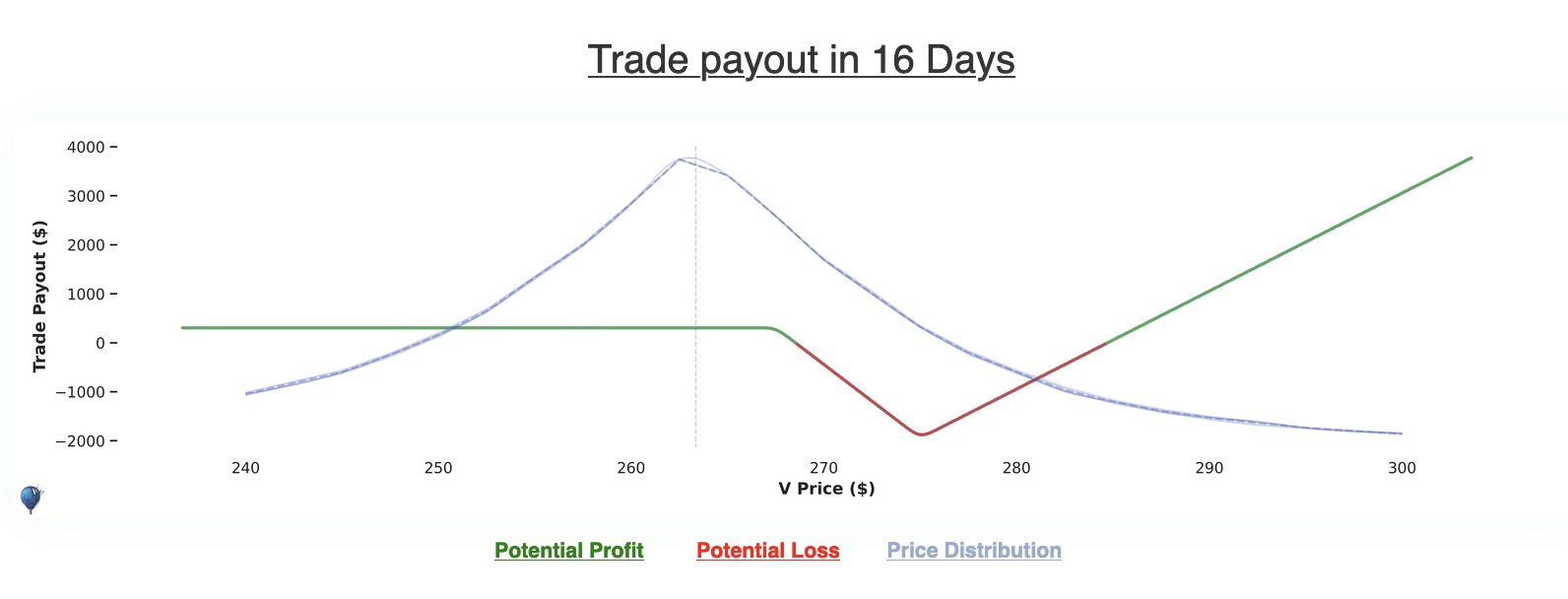

Short call spreads: An initially bearish strategy that profits from the underlying asset's price remaining below the strike price by the expiration date. However, if the underlying price blows past our longs strikes, the trade becomes bullish with long convexity. By selling call options and overhedging in the tail, traders can benefit from the premiums received while protecting against large price movements. This strategy is ideal for those who are bearish on the underlying asset or short volatility, offering a high probability of profit if the stock remains below the strike price.

Shorting calls, on the other hand, can be a lucrative strategy where we are bearish on the underlying or short volatility (Helium Short Volatility). By selling call options and overhedging in the tail, traders can benefit from the premiums received, betting that the underlying asset's price will not exceed the strike price by the expiration date, or that volatility will decrease in order to close out with an early profit.

Example: A trader sells a call option with a strike price of $105 for a stock trading at $100 and buys 2 $110 calls. If the stock remains below $105, the call spread expires worthless, and the trader keeps the premium. If the price blows past the long strike of $110, the long convexity offers potential for a juicy profit. This strategy will take a max loss if the underlying expires right at our long strike of $110.

Short Straddles or Strangles

All Helium trades are risk-defnined, meaning there is a finite max loss on each position. For those comfortable with more advanced (and risk-undefined) strategies, short straddles and strangles offer opportunities to profit from low realized volatility. These strategies involve selling both call and put options, expecting minimal movement in the underlying asset's price. In a short straddle, both options have the same strike price, while in a short strangle, they have different strike prices. Short straddles and strangles make the most sense when traders expect realized volatility to be lower than implied (as relfected in current prices)

Example: A trader sells a call and a put option with strike prices of $100 and $90, respectively, for a stock trading at $95. If the stock's price remains stable around $95, both options expire worthless, and the trader profits from the premiums received. This strategy requires careful risk management, as significant price movements can lead to substantial losses. Helium does NOT recommend naked options strategies for beginners.

What is the best trading strategy for volatility?

The optimal strategy depends on market conditions, market outlooks, and individual risk tolerance. Long debit spreads offer the highest reward:risk, albeit with a lower probability of profit. Helium recommends short ratio spreads (Helium Short Volatility) for those looking to capitalize on high implied volatility while protecting tail risk with long convexity. By buying more options than we are short, we can profit from large moves in either direction with a higher probability of profit.

Is trading volatility profitable?

It depends! Trading volatility can be highly profitable for those who understand the complexities and can accurately predict market movements. However, it also carries significant risk and requires a thorough understanding of options and market dynamics. In general, short volatility trading is profitable if realized volatility is less than implied. For long volatility trading, the opposite is true.

What moves volatility?

Volatility is influenced by factors such as economic data releases, random noise, corporate earnings reports, geopolitical events, dealer positioning, options flows, and market sentiment. Understanding these drivers and their interactions is crucial for successful volatility trading. Taking a probabilistic approach to volatility can help traders navigate these complexities and make informed decisions without getting caught up in the noise.

How do you beat volatility?

You don't! You embrace it. Volatility is a natural part of the market, and trying to "beat" it is a fool's errand. Instead, traders should focus on understanding volatility's mechanics and using it to their advantage. By employing strategies that align with empirical evidence and real-world applications, traders can profit from volatility without getting caught up in the weeds.

For more in-depth insights and strategies on trading volatility, visit Helium Trades.

Author: Conner Lambden

Conner is the founder of Helium Trades and a former computational scientist studying the immune system. Connect with Helium on Twitter.

Explore more strategies: Bullish Strategies | Bearish Strategies