AI-Optimized Trading Strategies

Predictive Modeling with Machine Learning

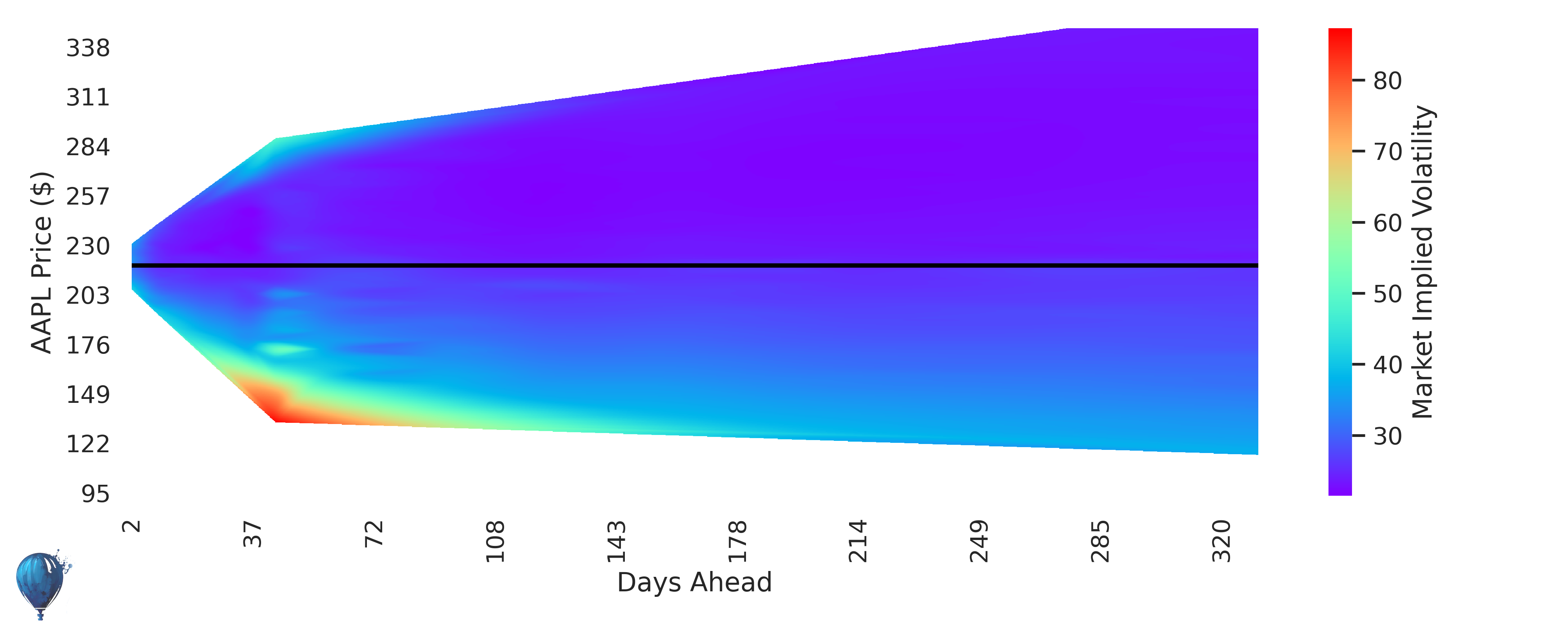

AAPL Volatility Surface where X axis is days ahead, y axis is SPY percent price change, and color is implied volatility

1. Strategy

Market modeling with machine learning leverages historical data, alternative data, news data, etc to forecast future market movements + volatilities + potential options strategies. By training an ensemble algorithms on vast datasets, Helium can identify patterns and trends that may not be visible through traditional analysis. These models use various techniques, such as decision trees, neural networks, and boosting in order to predict asset prices, options prices, and volatility.

2. Benefits

AI modeling offers a significant edge in trading by providing data-driven insights, reducing human biases, and processing an insane amount of information every day. It enables more accurate forecasts + access to more trading hypothesis— leading to better-informed trading decisions and optimized entry and exit prices. Additionally, it allows for the continuous improvement of strategies as models learn from new data + historical performance, ensuring strategies remain fresh and effective.

3. Challenges

While powerful, predictive modeling faces challenges such as overfitting, where models perform well on historical data (by over-optimizing) but fail to generalize to new data. Ensuring data quality and dealing with noisy or incomplete datasets can also hinder model accuracy. Given the dynamic nature of markets, models need constant updates, regularization, and monitoring to remain effective, less they fall victim to the red queen hypothesis.

Sentiment Analysis and Natural Language Processing (NLP)

1. Strategy

Sentiment analysis and NLP involve analyzing textual data from news articles (thousands of sources across the web), social media, and financials to gauge market sentiment. By processing and interpreting this unstructured data, Helium's AI can quantify the bullish/bearish/neutral tone and extract valuable insights regarding market participants' attitudes and potential actions.

2. Benefits

Sentiment analysis augments Helium's trading strategies by providing a real-time gauge of market sentiment that pulls information from the entire internet, enabling traders to anticipate market moves based on the collective mood as well as specific new information. This approach can identify emerging trends, shifts in investor/trader sentiment, and potential market-moving events, offering a proactive informational edge in trading.

3. Challenges

NLP models can struggle with the subtleties and complexities of human language, such as sarcasm, slang, advertising, and nuanced context. The vast and diverse sources of textual data require sophisticated filtering and processing techniques to ensure statistically significant relevance and accuracy. Additionally, the rapid pace of information flow necessitates real-time analysis capabilities to capitalize on sentiment-driven opportunities before the market prices in new information.

High-Frequency Trading (HFT) with AI Optimization

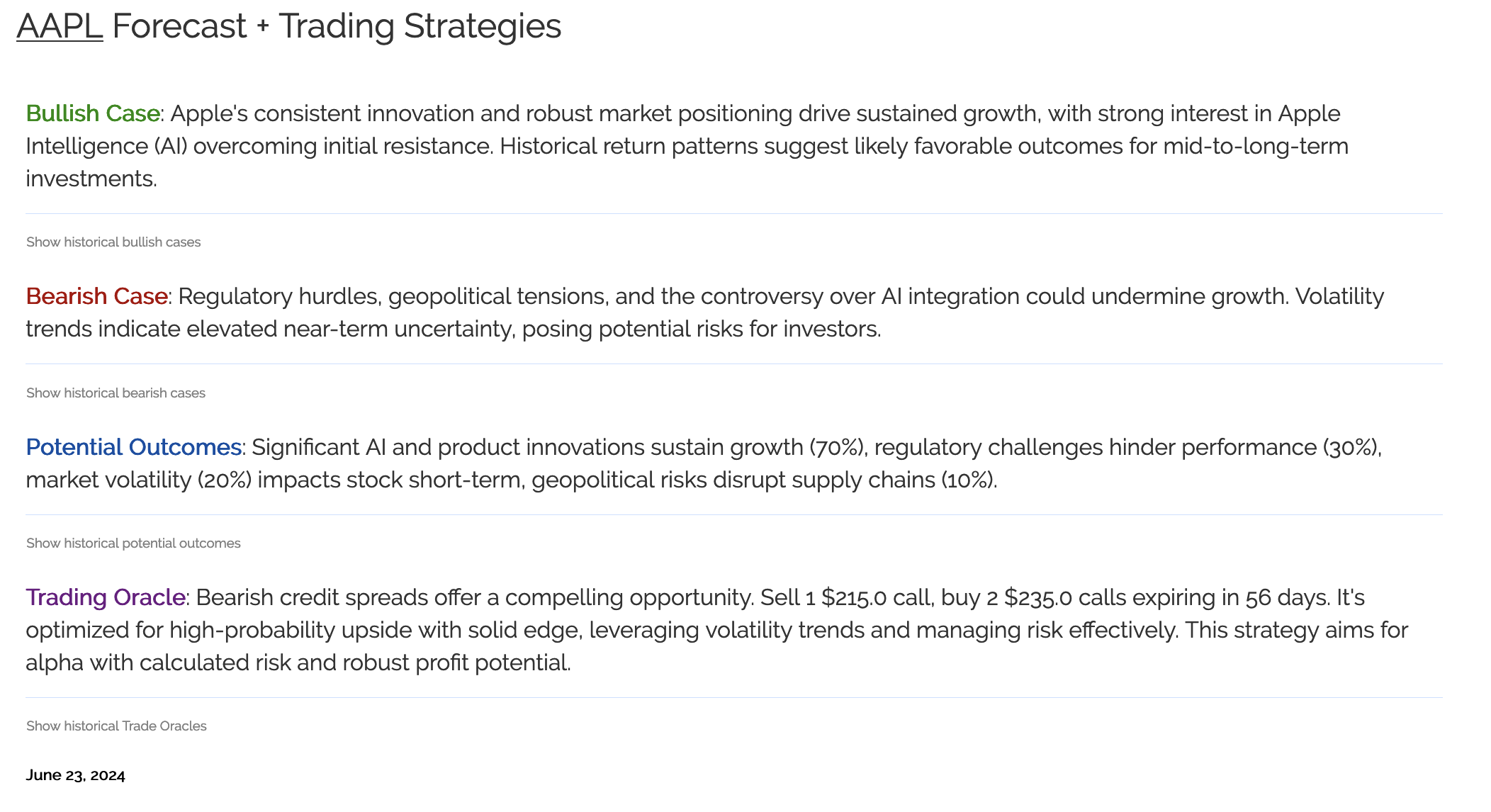

AAPL AI bullish case, bearish case, potential outcomes (with probabilities) and potential options trading strategies based on sentiment analysis

1. Strategy

High-frequency trading involves executing a large number of orders at extremely high speeds (think sub-milliseconds). AI optimization in HFT uses machine learning algorithms to optimize trading strategies, order execution, shady deals with exchanges, and latency. These algorithms analyze market data, predict short-term price movements (supply/demand inbalances), and make split-second decisions to capitalize on tiny price discrepancies. Helium's order execution uses a slower, marching algorithm that legs into options trades over the course of an entire day in order to get the best fills without expensive intrastructure.

2. Benefits

AI-optimized HFT provides a significant advantage by increasing trading speed (beating out other trades) and accuracy (selecting against uninformed traders). It enables traders to exploit short-term market inefficiencies and achieve higher returns with minimal risk (due to the short holding periods). The automation and precision of AI reduce human error and allow for continuous strategy refinement based on real-time data and huge historical datasets.

3. Challenges

The primary challenges in HFT with AI optimization include the need for low-latency infrastructure, high computational power, and sophisticated algorithms + datasets. Market volatility, adverse selection, and regulatory changes can also impact HFT strategies. Unfortunately, most retail traders lack the resources to realistically compete with high-frequency market makers such as Citadel.

Portfolio Optimization with AI

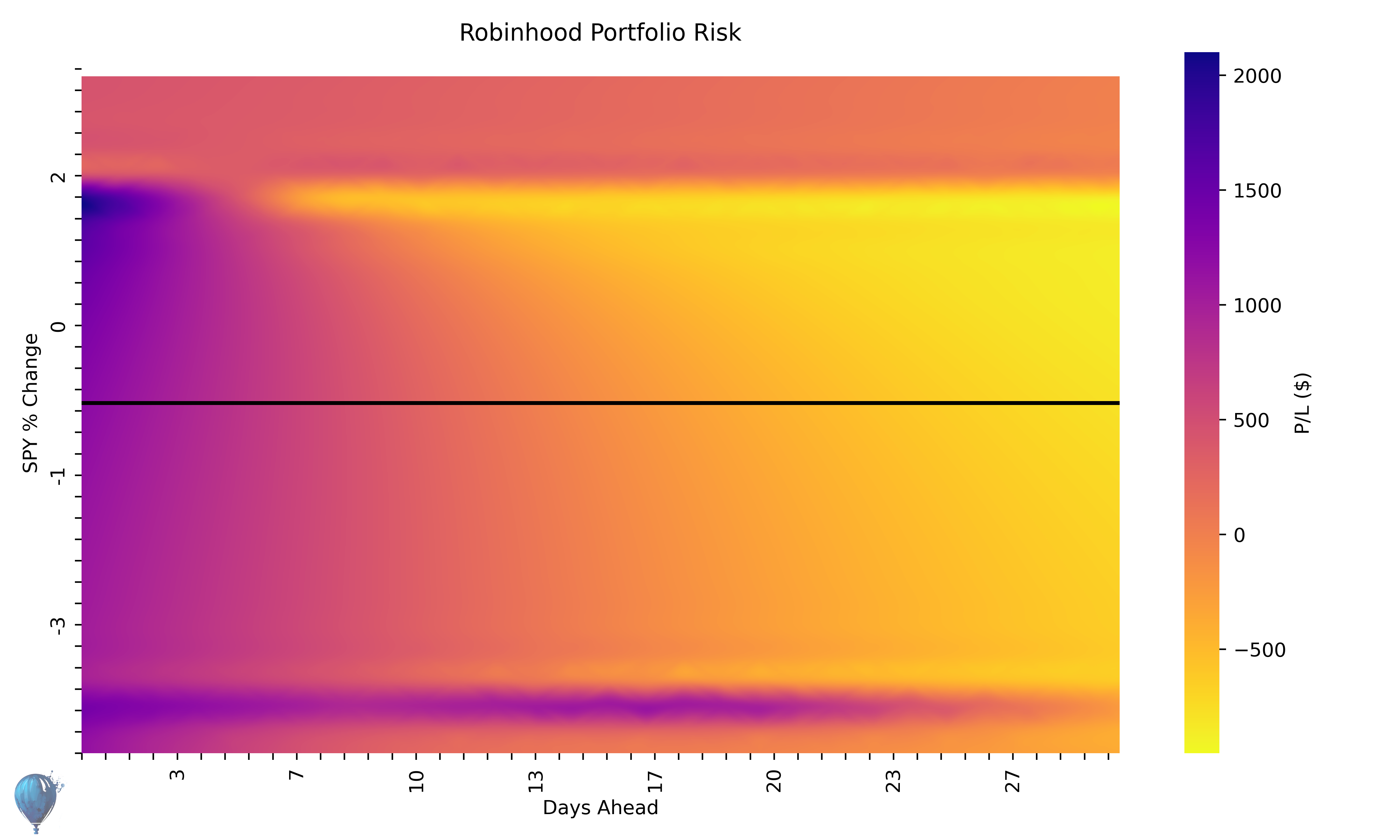

Portfolio Risk Surface where X axis is days ahead, y axis is SPY percent price change, and color is potential P/L

1. Strategy

Portfolio optimization with AI involves using advanced algorithms to construct, manage, and balance investment portfolios. These algorithms analyze historical and real-time data to balance risk and return, diversify assets, and align with investors' goals. Techniques such as mean-variance optimization (Markowitz), balancing portfolio greeks, Monte Carlo simulations, simple rules-based balancing, and genetic algorithms are commonly used.

2. Benefits

AI-driven portfolio optimization offers precise and bespoke investment strategies, maximizing returns while minimizing risk. It can easily adapt to changing market conditions and incorporate new data to continuously refine portfolio allocations. The automation of portfolio management reduces the time and effort required from investors, making it more accessible and efficient for retail traders. Helium Autotrader automatically tries to "push" portfolio towards beta-neutral as measured by SPY risk while maintaining a portfolio that is net long vega/gamma. In addition to maintaining a delta-neutral portfolio, Helium can hedge each trade with another trade from a highly correlated/uncorrelated ticker (trade balancing) in order to diversify away some risk and increase the odds of profit.

3. Challenges

Challenges in AI portfolio optimization include the complexity of modeling financial markets, the risk of model overfitting, markets moving faster than you can hedge, and the need for high-quality price data. Ensuring the robustness and resilience of portfolios in different market scenarios is critical for reducing idiosyncratic risk of specific trades as well as portfolio net risks. Additionally, managing gamma/delta/vega risk involves tradeoffs with uncertain outcomes. This is what makes trading part art, and part science.

Algorithmic Trading with AI-Powered Order Execution

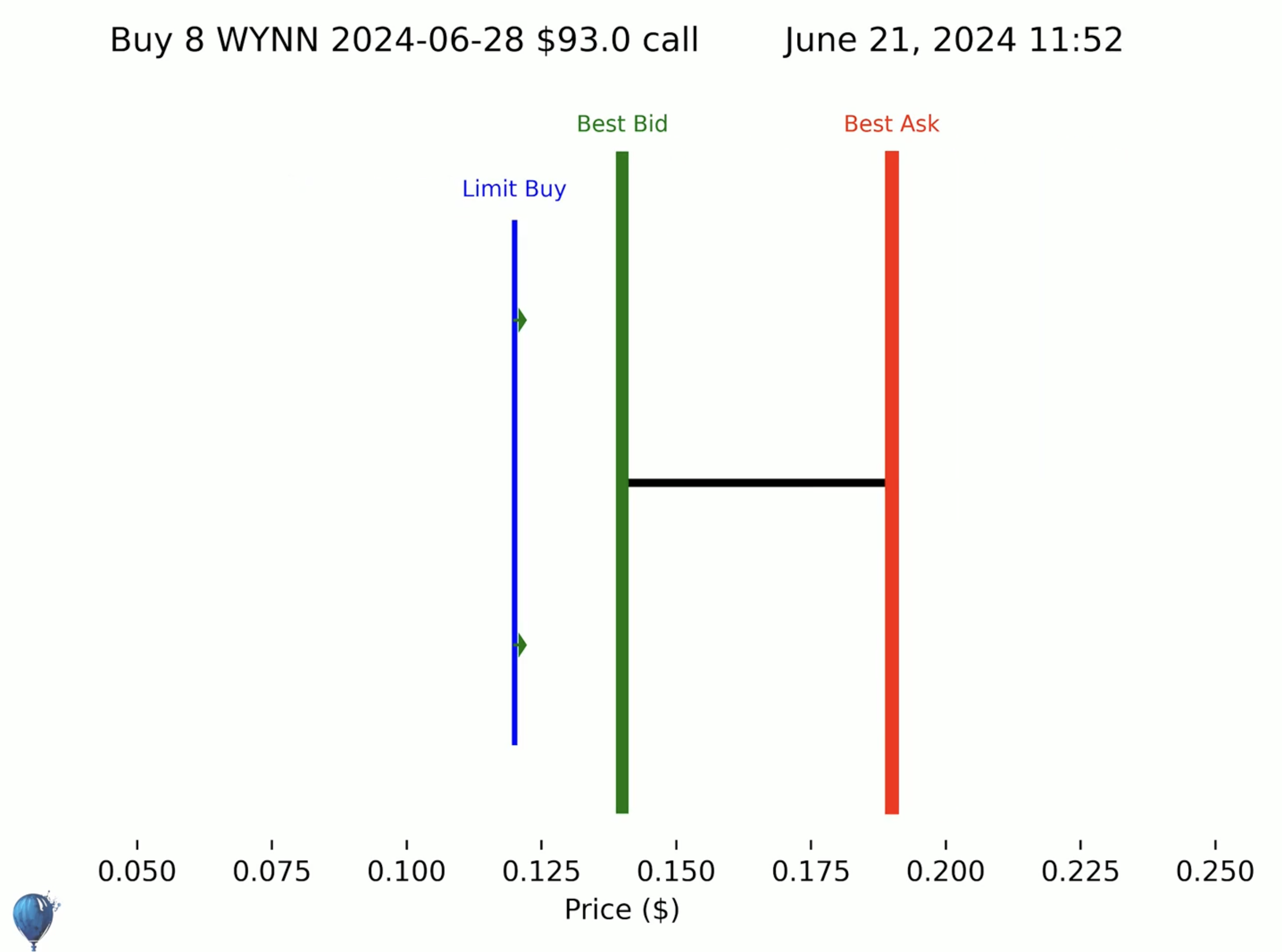

Helium Trade Executor screenshot showing limit buy order (blue), current market bid (green), and current market ask (red)

1. Strategy

Algorithmic trading uses AI to execute limit orders based on predefined rules and market conditions. AI-powered order execution optimizes the timing, size, and price of trades to minimize market impact and maximize profitability by getting the best fills. These algorithms analyze market data, predict order book dynamics, and adjust strategies in real-time.

2. Benefits

AI-powered algorithmic trading enhances efficiency and precision in executing options spreads. It reduces transaction costs, improves liquidity by making markets, and minimizes the impact of large orders on the market. The ability to process vast amounts of data and adapt to market conditions in real-time provides a competitive edge and enhances overall trading performance for retail options traders. Helium's algorithms slowly move limit buy (sell) orders towards the best offer (bid) over time in order to force the market to give orders the best fills.

3. Challenges

Implementing AI-powered algorithmic trading requires robust infrastructure, high-speed data feeds, and sophisticated algorithms. The dynamic nature of markets means that strategies need constant monitoring and adjustment. The most common risk when legging into options positions is sudden price movements of the underlying and changes in volatility where the execution algo ends up "chasing" the market, and the long leg gets filled at a high price and the short leg gets filled at a low price.

Risk Management with AI-Driven Monitoring and Alerts

1. Strategy

AI-driven risk management involves monitoring market conditions, portfolio performance, trade P/Ls, and external factors to identify and mitigate potential risks (as well as spotting potential market opportunities). AI algorithms analyze real-time data to detect anomalies, measure P/L, predict risk events, and generate alerts for timely interventions such as closing out early. This conservative approach enhances the resilience and stability of trading strategies, and early profit taking allows portfolios to compound more quickly by increasing the total number of trades made.

2. Benefits

AI-driven risk management provides a comprehensive, empirical, and dynamic view of risk— enabling traders to respond swiftly to changing conditions in a rational, un-emotional manner. It enhances the accuracy of risk assessments, reduces human biases, and improves decision-making. The automation of monitoring and alerts ensures continuous vigilance and quick action to prevent significant losses with no need to be constantly in front of a screen.

3. Challenges

Challenges in AI-driven risk management include the complexity of integrating diverse data sources, the need for real-time processing capabilities, and the risk of false positives in alerts (the risk of overtrading). Ensuring the robustness and reliability of risk models under different market scenarios is crucial (algorithms with bugs can lose LOTS of money very quickly). Additionally, transparency and interpretability of AI decisions are important for gaining trader confidence and trust.

Author: Conner Lambden

Conner is the founder of Helium Trades and a former computational scientist studying the immune system. Connect with Helium on Twitter.