AI Optimized Volatility Strategies

Supercharge Your Trading With State of The Art Trades

How to use volatility in trading

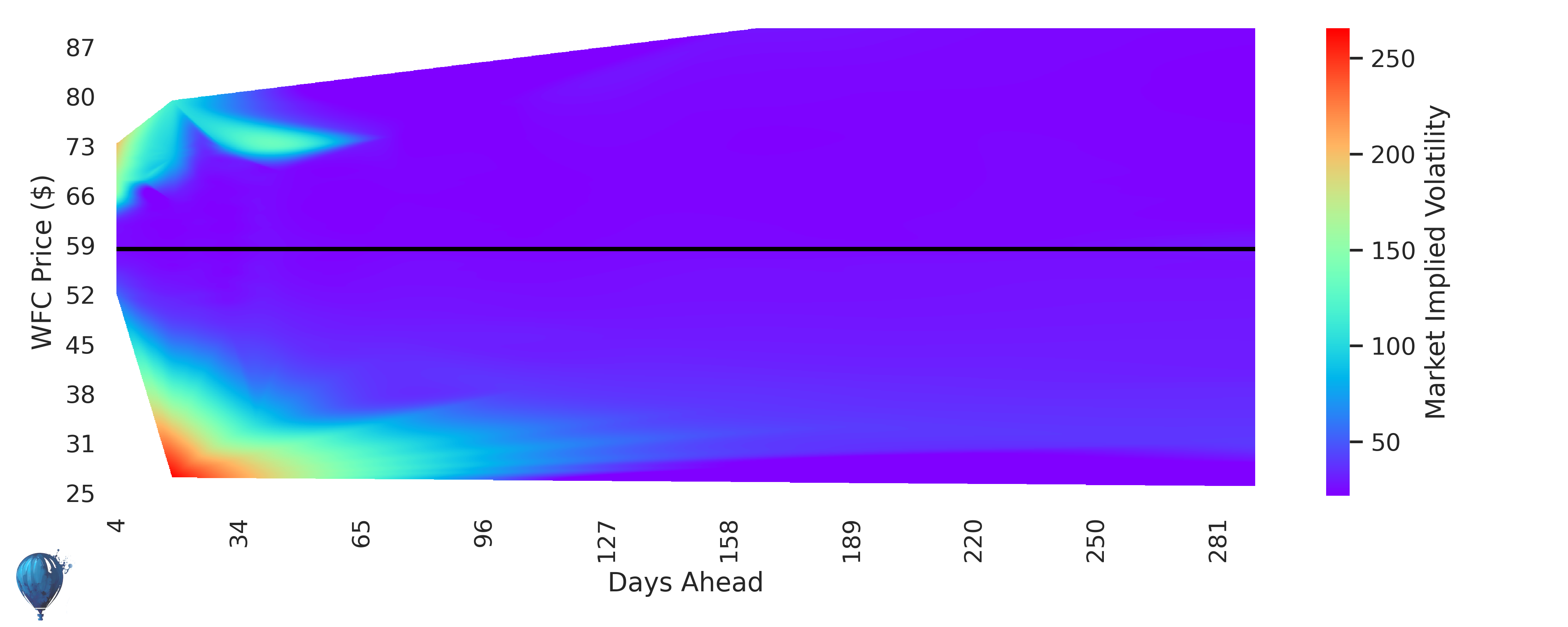

Volatility is a critical component in trading, especially in options trading— even if a trade is delta neutral, all options trades are also implicitly volatility bets, based on the implied volatility of the options bought and sold. Understanding how to capitalize on volatility can significantly enhance your strategies and improve your overall performance through selling highly-demanded implied volatility and buying over-supplied volatility. Volatility represents the variation/change in the price of a financial instrument over time, and it is often used as a measure of risk.

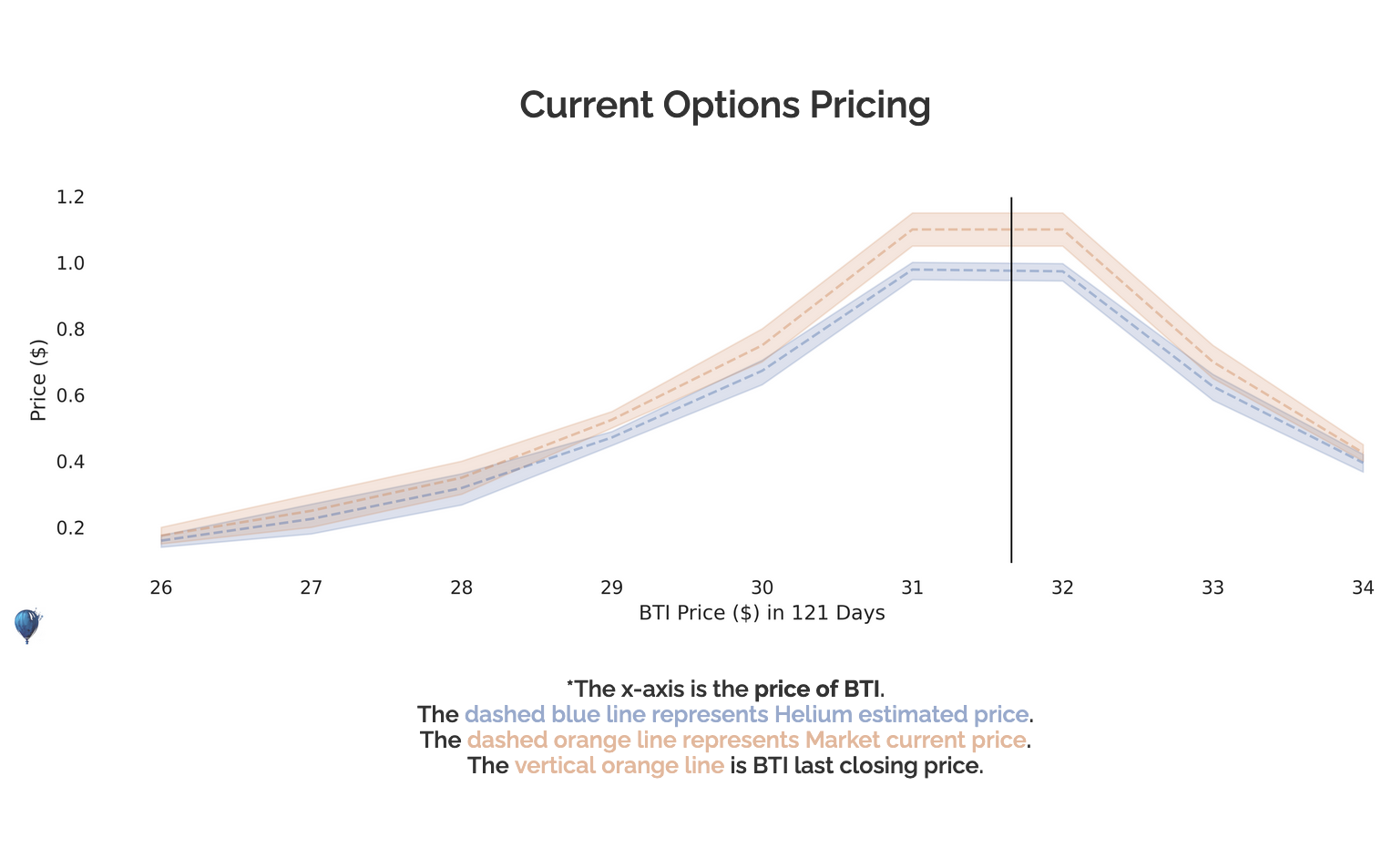

Helium leverages volatility to predict price movements and to hedge risks effectively. Helium structures trades to be short options who's implied volatility is potentially overpriced, and long options who's implied volatility is potentially underpriced.

Long Volatility Strategies

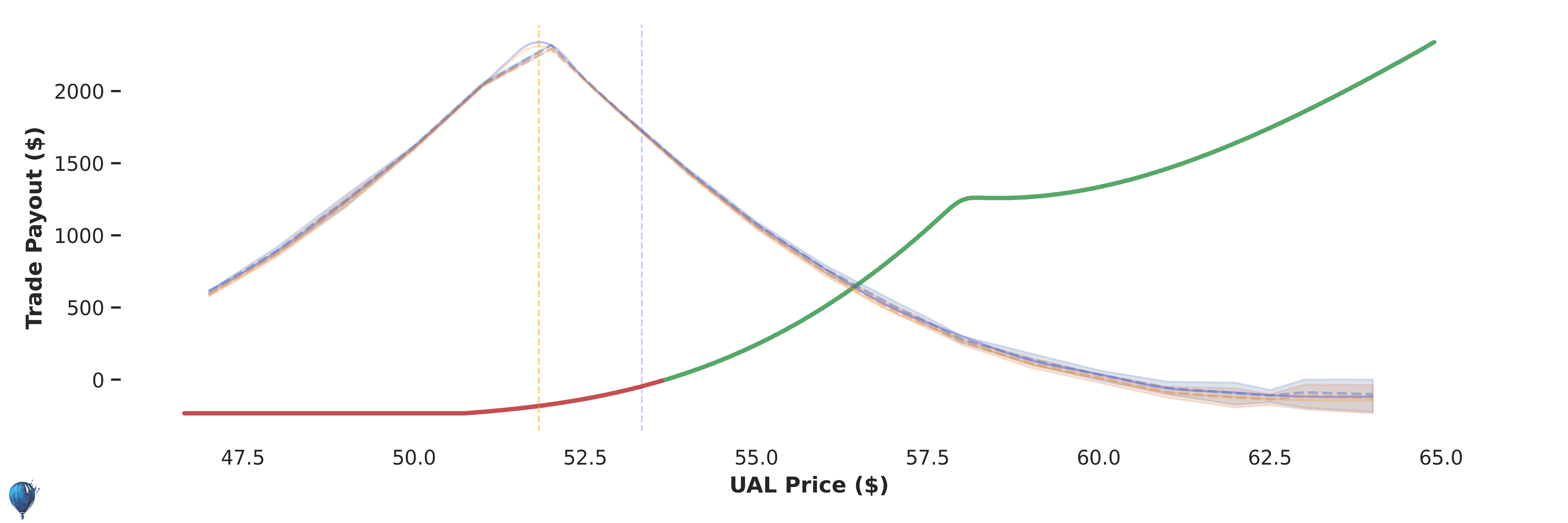

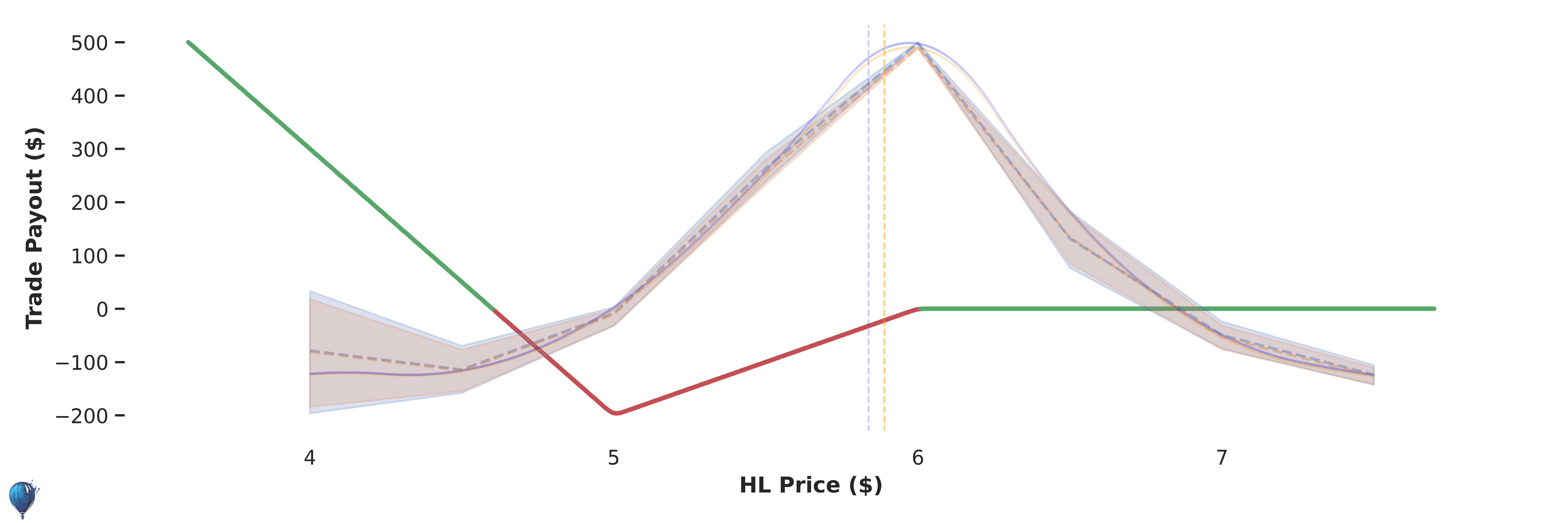

Helium's long volatility strategies involve purchasing lower delta options debit spreads to benefit from significant price movements. For instance, buying Out-of-the-Money (OOTM) call spreads when anticipating a bullish trend allows traders to capitalize on large price spikes with minimal initial investment. This strategy is particularly effective during periods of high market uncertainty and can profit asymmetrically from large price movements and increases in implied volatility.

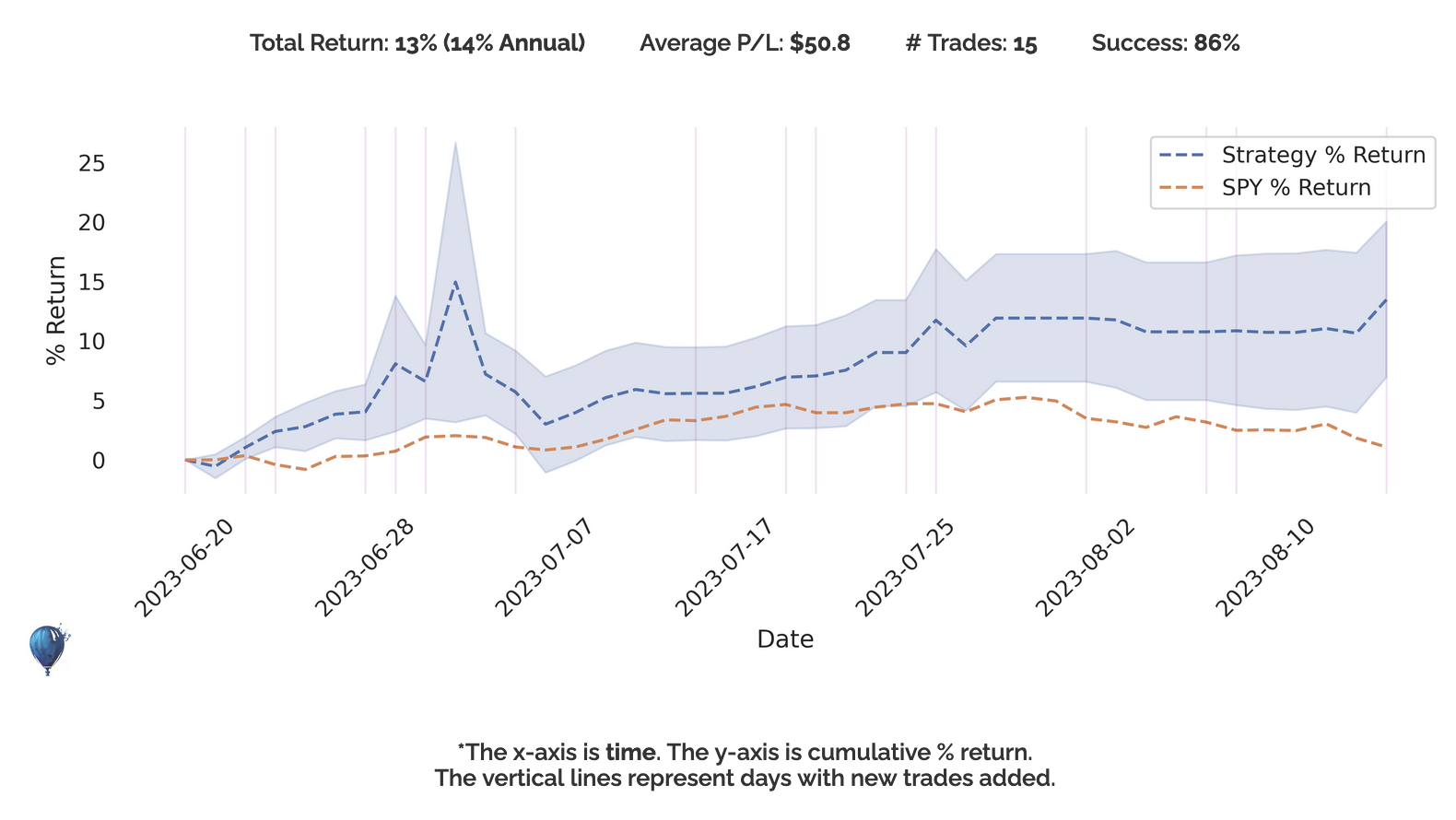

Retail Option Trading Made Easy

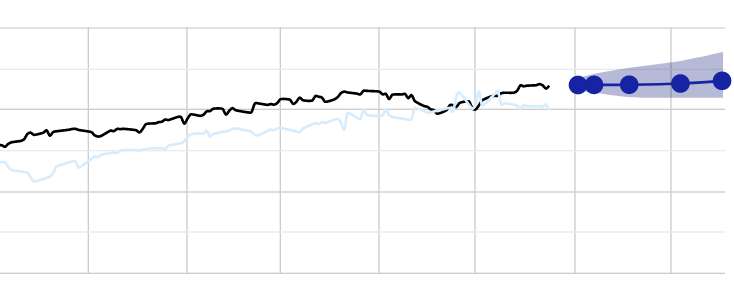

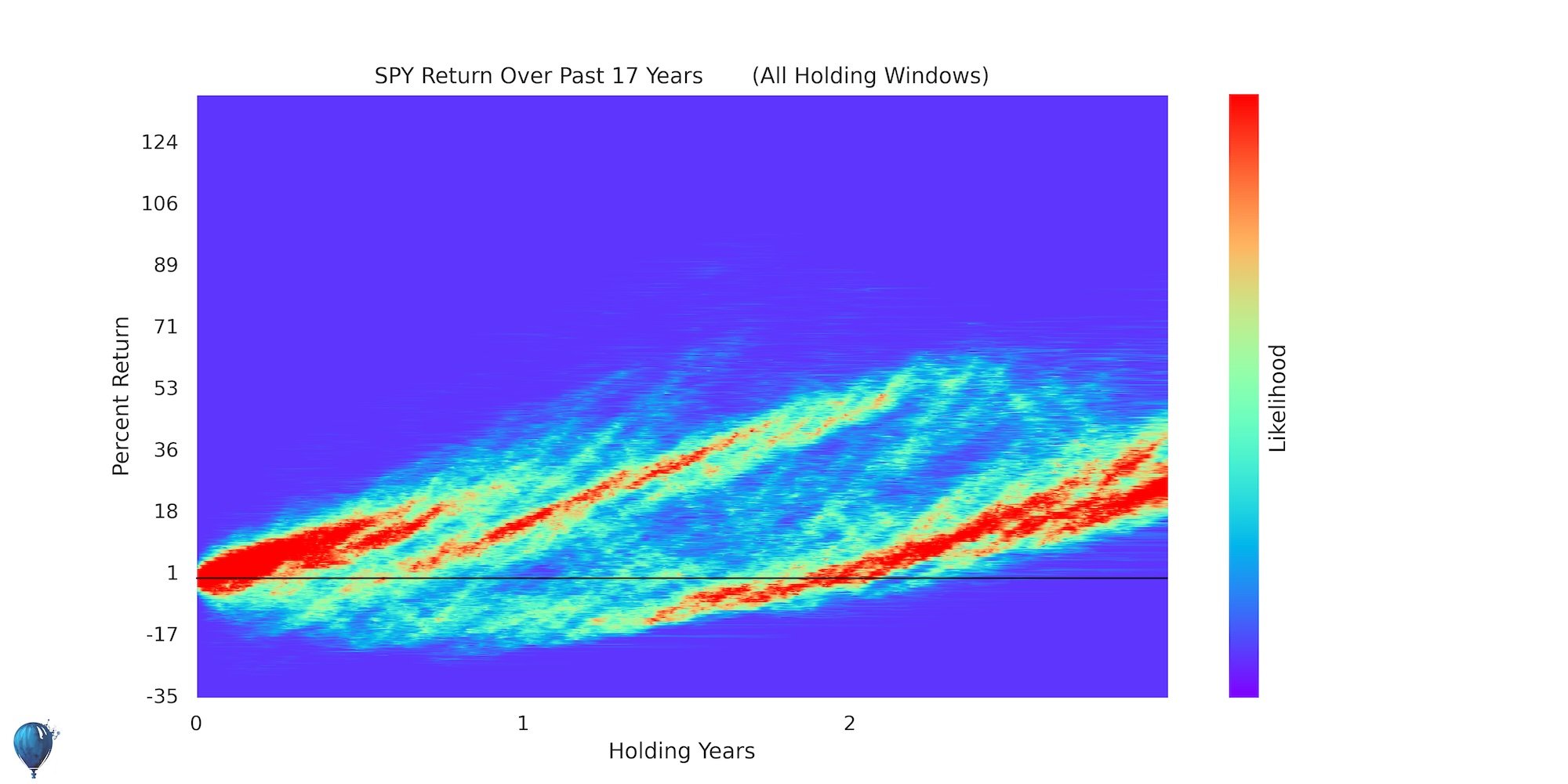

Leverage Volatility Models Previously Only Accessible by Large Institutions. See past performance for all trading strategies to help you guage the returns compared to SPY. Helium feeds live trading performance back into it's optimization algorithm in order to help steer new trades.

Short Volatility Strategies

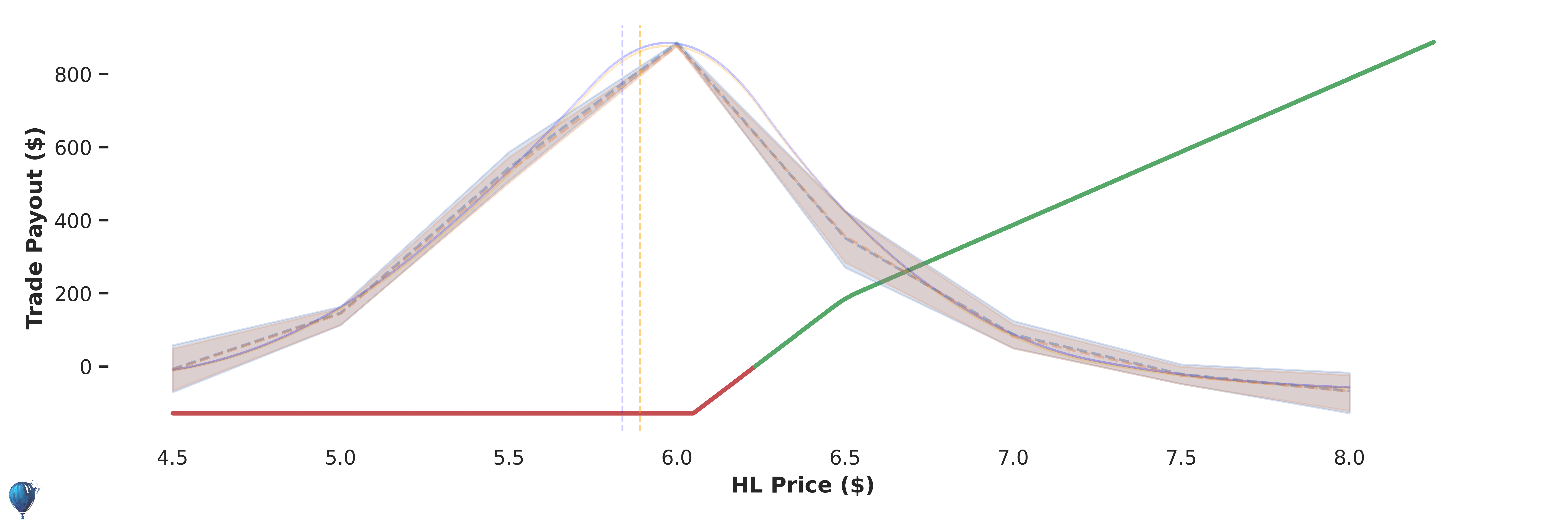

Short volatility strategies entail selling options (market insurance) to profit from stable or less volatile markets. At HeliumTrades, we specialize in selling At-the-Money (ATM) options while simultaneously buying multiple OOTM options as a hedge. This approach provides a balanced risk profile by capturing premium from sold options while protecting against unforeseen market movements.

Volatility Spreads

Volatility spreads, such as straddles and strangles, involve buying and selling options simultaneously to take advantage of changes in volatility + time decay without predicting the direction of the market. For example, a long straddle involves buying both a call and a put option at the same strike price and expiration date. This strategy profits from significant moves in either direction as well as increases in implied volatility. Helium doesn't trade short straddles/strangles due to the uncapped risk— all Helium trades have defined max risk to limit large losses.

Long Straddle

A long straddle involves buying both a call and a put option at the same strike price and expiration date. This strategy is ideal for traders expecting significant price movements (or implied volatility increases) but uncertain about the direction. The potential for profit increases with the magnitude of the price movement, whether up or down as well as increases in implied volatility. Helium leans more towards lower delta options to reduce the upront cost of being long options.

Short Straddle (or Strangle)

A short straddle involves selling both a call and a put option at the same strike price and expiration date. This strategy is suited for stable markets where significant price movements are unlikely. By capturing the premiums from both options, traders can profit from time decay and low volatility. However, Helium avoids short strangles due to the asymmetric risk profile and potential for huge losses.

Volatility Indicators

Bollinger Bands

Bollinger Bands are a volatility indicator that consist of a moving average and two standard deviation lines. They help traders identify overbought or oversold conditions. When the price touches the upper band, it indicates potential overbought conditions, while touching the lower band suggests oversold conditions. Helium's models use probabilistic indicators (including confidence intervals and expected-value calculations across the entire distribution) in order to help price potential risks + rewards.

Average True Range (ATR)

The Average True Range (ATR) measures market volatility by calculating the average of true price ranges over a specified period. (Higher ATR values indicate higher volatility) Helium uses ATR to help measure price trends, autocorrelation and mean reversion for underlying prices. For example, if Helium was bullish on an underlying, long call spreads on that ticker would be weighted higher.

Keltner Channels

Keltner Channels are volatility-based envelopes set above and below an exponential moving average. The channels adjust based on the ATR (Average True Range), making them responsive to market volatility. They help traders identify trend directions and potential reversals. Similarly, Helim's 80% confidence interval graphs make it easy to see a rough estimate of the distribution of future prices for all tickers.

Donchian Channels

Donchian Channels are formed by the highest high and the lowest low over a specified period. They are used to identify potentially overbought and oversold, and are used by Helium's AI options pricer to determine prices and fit Helium's volatility surface.

Volatility Index (VIX)

The Volatility Index (VIX) measures market expectations of short-term volatility conveyed by a strip of S&P 500 index option prices. Often referred to as the "fear gauge," VIX is basically a variance swap behind the scenes, so the square of standard deveation which has positive convexity. A high VIX indicates increased investor fear and uncertainty, while a low VIX suggests complacency/calm. Helium's graphs help distill market expectations into a simple, easy-to-understand chart.

How Do Helium’s Strategies Work?

At HeliumTrades, we combine these volatility indicators + other data sources to rank our top trades every day. Our strategies are rooted in empirical data and designed to optimize your trading performance through a probabilistic, mathematical perspective.

Whether you are employing volatility trading strategies like long volatility, short volatility, or volatility spreads, understanding and utilizing these indicators and considering the context of hisotical volatility can enhance your decision-making process. Helium Trades provides a sophisticated platform that simplifies the execution of these strategies, helping you become a more profitable volatility trader.

Our platform scans over 250 million potential trades daily, offering you optimized forecasts for 8,000 stocks and digital assets. With balanced news analyzed by AI from 39,000 sources, HeliumTrades ensures you have access to comprehensive, data-driven insights to make informed decisions.

Join Helium Trades today and leverage advanced models previously accessible only to large institutions. Start with our free month trial and experience the power of optimized trading strategies. If you don't make over $60 in your first month, we'll refund your money.

Become a more profitable volatility trader with HeliumTrades, where sophisticated strategies and cutting-edge technology meet to deliver exceptional trading results.

Author: Conner Lambden

Conner is the founder of Helium Trades and a former computational scientist studying the immune system. Connect with Helium on Twitter.