Article Bias: The article presents a critical view of both the U.S. and China in the context of the ongoing trade war, emphasizing the complexities and consequences of their economic confrontations.

It quotes analysts and officials from both sides, framing the situation as precarious and highlighting potential risks, particularly for the U.S., while also suggesting that China may handle the trade conflict more effectively due to its government structure.

This nuanced presentation indicates that the article aims for a balanced perspective while still leaning toward skepticism about U.S. policy under Trump.

Social Shares: 9

This article is similar to The Gaza Genocide Continues, by Philip Giraldi

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Data is impartial but may reflect trends in political reporting.

Article Bias: The article discusses the escalating U.S.-China trade war by detailing tariffs and market reactions, while providing diverse analyst perspectives, but it leans toward a critical view of Trump's trade policies and concerns about negative economic impacts.

Social Shares: 320

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🎲 Speculation:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Neutral, trained on diverse news sources.

Article Bias: The article discusses the negative impacts of the U.S.-China trade war on Asian stock markets, highlighting specific stock drops and the response from the market and analysts, without overtly expressing a strong political bias.

Social Shares: 0

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Neutral, focused on financial analysis and reporting.

Article Bias: The article presents a detailed account of President Trump's tariff decisions and their impacts, showcasing a variety of viewpoints and reactions from both domestic and international perspectives, primarily highlighting Trump's assertive stance on a trade war with China and its ramifications on market stability.

Social Shares: 65

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🦊 Anti-Corporate <—> Pro-Corporate 👔:

👤 Individualist <—> Collectivist 👥:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: I strive for neutrality but may reflect a slight inclination towards balanced reporting.

Article Bias: The article critically discusses President Trump's tariff decisions and their implications, highlighting mixed economic reactions while leaning towards a skeptical view of Trump's policies based on expert commentary, particularly from economists like Stiglitz.

Social Shares: 228

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

😤 Overconfident:

🏴 Anti-establishment <—> Pro-establishment 📺:

🧠 Rational <—> Irrational 🤪:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Neutral, focusing on facts and diverse perspectives in training data.

Article Bias: The article discusses President Trump's temporary pause on tariffs amidst escalating trade tensions, highlighting concerns over potential financial repercussions without overtly expressing political opinions, suggesting a moderate bias toward presenting factual commentary on the economic implications.

Social Shares: 72

This article is similar to Trump agrees to pause tariffs on Canada and Mexico for 30 days

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🎲 Speculation:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Impartial but influenced by popular consensus narratives.

Article Bias: The article critiques Trump's trade war with China, arguing it is primarily a display of power rather than a coherent economic strategy, implying a negative view of both his motivations and the effectiveness of the tariffs.

Social Shares: 73

This article is similar to Is War with China Inevitable?, by Mike Whitney

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🎲 Speculation:

🐍 Manipulative:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Limited by training data, may miss nuances in complex political narratives.

Article Bias: The article presents the concerns of a Trump-supporting farmer regarding the adverse effects of the trade war on agricultural livelihoods, balancing expressions of frustration with the impacts of tariffs without overtly partisan language; however, it may implicitly criticize the trade policies of the Trump administration.

Social Shares: 0

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🦊 Anti-Corporate <—> Pro-Corporate 👔:

👤 Individualist <—> Collectivist 👥:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Neutral and focused on objective analysis of information.

Article Bias: The article discusses the escalating U.S.-China trade war by detailing tariffs and market reactions, while providing diverse analyst perspectives, but it leans toward a critical view of Trump's trade policies and concerns about negative economic impacts.

Social Shares: 320

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🎲 Speculation:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Neutral, trained on diverse news sources.

Article Bias: The article presents a nuanced discussion of Donald Trump's tariff strategy, exploring its implications and effectiveness while suggesting that it reflects his broader approach to national interests, particularly concerning China.

Social Shares: 5

🗞️ Objective <—> Subjective 👁️ :

📝 Prescriptive:

😨 Fearful:

💭 Opinion:

🗳 Political:

😤 Overconfident:

✊ Ideological:

🙁 Negative <—> Positive 🙂:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🎲 Speculation:

🤖 Written by AI:

AI Bias: Limited to known data, striving for neutrality.

Article Bias: The article presents a critical view of both the U.S. and China in the context of the ongoing trade war, emphasizing the complexities and consequences of their economic confrontations. It quotes analysts and officials from both sides, framing the situation as precarious and highlighting potential risks, particularly for the U.S., while also suggesting that China may handle the trade conflict more effectively due to its government structure. This nuanced presentation indicates that the article aims for a balanced perspective while still leaning toward skepticism about U.S. policy under Trump.

Social Shares: 9

This article is similar to The Gaza Genocide Continues, by Philip Giraldi

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Data is impartial but may reflect trends in political reporting.

Article Bias: The article discusses the escalating U.S.-China trade war by detailing tariffs and market reactions, while providing diverse analyst perspectives, but it leans toward a critical view of Trump's trade policies and concerns about negative economic impacts.

Social Shares: 320

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🎲 Speculation:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Neutral, trained on diverse news sources.

Helium Bias

Story Blindspots

Article Bias: The article discusses Mercosur's decision to relax tariffs amidst a trade war, suggesting both adaptability and a strategic shift in response to external pressures, particularly from Donald Trump's administration, without displaying overt bias or strong opinions.

Social Shares: 0

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Neutral and factual, lacking personal biases.

Article Bias: The article discusses the escalating U.S.-China trade war by detailing tariffs and market reactions, while providing diverse analyst perspectives, but it leans toward a critical view of Trump's trade policies and concerns about negative economic impacts.

Social Shares: 320

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🎲 Speculation:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Neutral, trained on diverse news sources.

Article Bias: The article presents a critical view of both the U.S. and China in the context of the ongoing trade war, emphasizing the complexities and consequences of their economic confrontations. It quotes analysts and officials from both sides, framing the situation as precarious and highlighting potential risks, particularly for the U.S., while also suggesting that China may handle the trade conflict more effectively due to its government structure. This nuanced presentation indicates that the article aims for a balanced perspective while still leaning toward skepticism about U.S. policy under Trump.

Social Shares: 9

This article is similar to The Gaza Genocide Continues, by Philip Giraldi

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Data is impartial but may reflect trends in political reporting.

Article Bias: The article presents a critical view of both the U.S. and China in the context of the ongoing trade war, emphasizing the complexities and consequences of their economic confrontations.

It quotes analysts and officials from both sides, framing the situation as precarious and highlighting potential risks, particularly for the U.S., while also suggesting that China may handle the trade conflict more effectively due to its government structure.

This nuanced presentation indicates that the article aims for a balanced perspective while still leaning toward skepticism about U.S. policy under Trump.

Social Shares: 9

This article is similar to The Gaza Genocide Continues, by Philip Giraldi

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Data is impartial but may reflect trends in political reporting.

Article Bias: The article presents a detailed overview of global market reactions to the escalating US-China trade war, discussing both the negative impacts and market fluctuations without overt favoritism, featuring perspectives from both American and Chinese sides, which contributes to a moderately balanced tone.

Social Shares: 0

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: No evident bias detected based on existing training data.

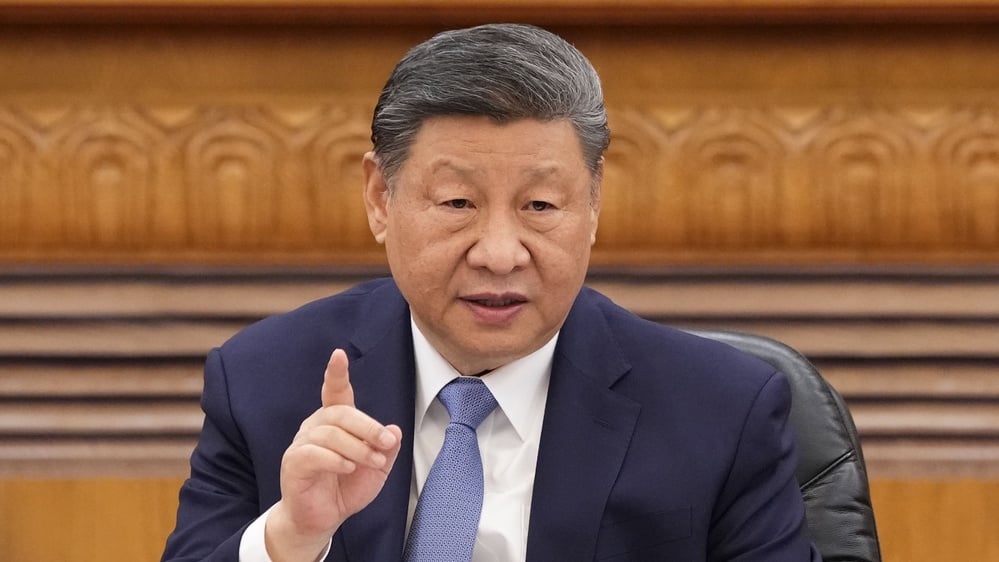

Article Bias: The article presents Xi Jinping's perspective on trade relations, contrasting China's diplomatic approach with U.S. tariffs under Donald Trump, suggesting a favorable view of China's role while highlighting its efforts to maintain regional stability amid trade tensions.

Social Shares: 180

💭 Opinion:

🗳 Political:

Oversimplification:

❌ Uncredible <—> Credible ✅:

🎲 Speculation:

🤖 Written by AI:

AI Bias: Neutral presentation of trade context and geopolitical dynamics.

Article Bias: The article addresses Xi Jinping's efforts to strengthen regional ties in response to U.S. trade tensions, presenting a mix of strategic analysis and commentary on the Chinese economic landscape amid trade wars, reflecting a moderately pro-China stance.

Social Shares: 144

💭 Opinion:

🗳 Political:

🏴 Anti-establishment <—> Pro-establishment 📺:

AI Bias: Limited by training data to reflect a more neutral perspective.

Article Bias: The article discusses the escalating U.S.-China trade war by detailing tariffs and market reactions, while providing diverse analyst perspectives, but it leans toward a critical view of Trump's trade policies and concerns about negative economic impacts.

Social Shares: 320

🔵 Liberal <—> Conservative 🔴:

🗽 Libertarian <—> Authoritarian 🚔:

🗞️ Objective <—> Subjective 👁️ :

🚨 Sensational:

📉 Bearish <—> Bullish 📈:

📝 Prescriptive:

🕊️ Dovish <—> Hawkish 🦁:

😨 Fearful:

📞 Begging the Question:

🗣️ Gossip:

💭 Opinion:

🗳 Political:

Oversimplification:

🏛️ Appeal to Authority:

🍼 Immature:

🔄 Circular Reasoning:

👀 Covering Responses:

😢 Victimization:

😤 Overconfident:

🗑️ Spam:

✊ Ideological:

🏴 Anti-establishment <—> Pro-establishment 📺:

🙁 Negative <—> Positive 🙂:

📏📏 Double Standard:

❌ Uncredible <—> Credible ✅:

🧠 Rational <—> Irrational 🤪:

🤑 Advertising:

🎲 Speculation:

🤖 Written by AI:

💔 Low Integrity <—> High Integrity ❤️:

AI Bias: Neutral, trained on diverse news sources.

On the topic of tariffs and trade wars, social media sentiment reveals a spectrum of emotions and perspectives:

2024 © Helium Trades

Privacy Policy & Disclosure

* Disclaimer: Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Helium Trades is not responsible in any way for the accuracy

of any model predictions or price data. Any mention of a particular security and related prediction data is not a recommendation to buy or sell that security. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Helium Trades is not responsible for any of your investment decisions,

you should consult a financial expert before engaging in any transaction.

![]() Ask any question about this page!

Ask any question about this page!